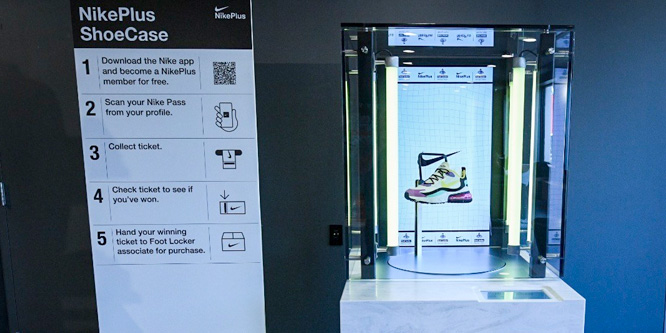

How can retailers bring the best of digital commerce to physical stores?

© 2024 RetailWire · Privacy Policy · Community Guidelines · Sitemap