Should retailers just say ‘no’ to Instacart?

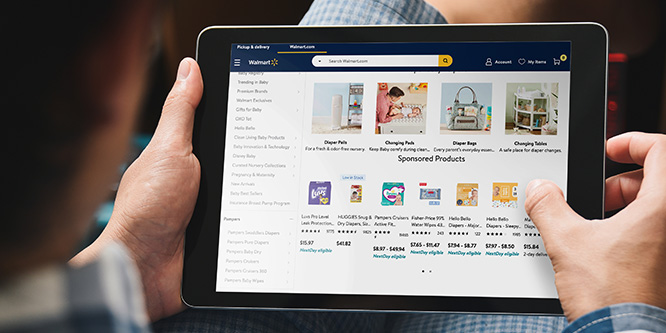

Are brands seeing a halo effect from ads on retailers’ online platforms?

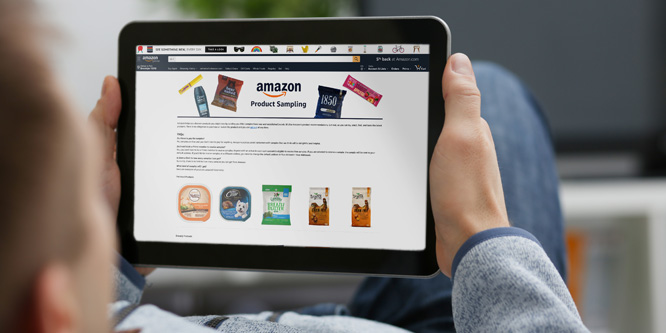

Will Amazon succeed with brand sampling rooted in machine learning?

Brands are simply guests on Amazon’s platform and that’s okay

Will Amazon conquer digital advertising platforms next?