Photo: @prissy4 via Twenty20

Will Walmart’s new online pet pharmacy and vet clinics draw more pet parents?

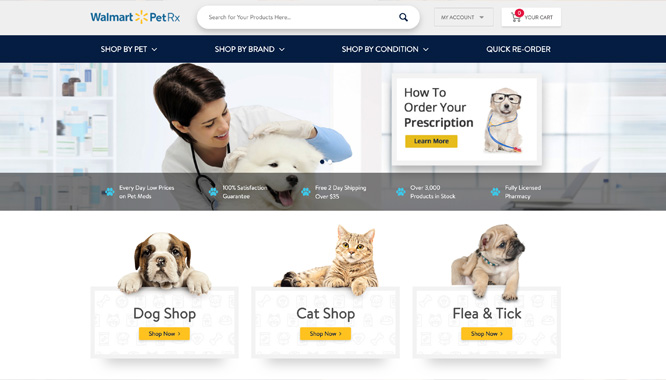

Walmart has announced the launch of WalmartPetRX.com, an online pharmacy for dogs, cats and other animals. As with all things Walmart, the retailer is promising to deliver said prescriptions to America’s four-legged family members at lower prices than the competition, and with free two-day shipping on orders over $35.

Walmart will sell over 300 pharmaceutical brands to cover a wide range of pet health needs. In keeping with the chain’s omnichannel approach to serving customers where, when and how they want to shop, it will also stock the 30 most prescribed pet meds at its more than 4,500 pharmacies.

The retailer also announced plans to expand the number of veterinary clinics inside the chain’s stores from its current 21 to 100 over the next 12 months. Walmart will add nine new clinics in stores in the Dallas-Fort Worth market this month and next.

The clinics, Walmart claims, may save customers as much as 60 percent on pet exams, immunizations and minor illness packages. In a release, which pointed to a statistic that 68 percent of U.S. households include a pet and 90 percent of Americans living within 10 miles of one of its stores, Walmart left open the potential for an expansion of the clinics beyond those just announced.

Walmart is clearly keen to capture greater share of the lucrative pet parent market. The retailer cited statistics showing that Millennial dog owners, for example, spend $1,285 annually on food, supplies and veterinary care.

The chain cited its increased selection of grain-free, organic and other foods and supplements as another reason consumers should choose Walmart for their pet needs. Walmart said it has added more than 100 new pet brands over the last year. It also touted private labels — Pure Balance, Golden Rewards and Vibrant Life — that include premium ingredients at about three-quarters the price of their national brand equivalents.

Discussion Questions

DISCUSSION QUESTIONS: How long do you think it will take for Walmart to become a major retail supplier of pet prescription medicines with its new online pharmacy and expanded selection in stores? Where do you see the chain headed with its veterinary clinic initiative?

This makes enormous sense for Walmart to pursue. It is a logical extension of being the go-to store for so many family needs. I don’t think it will be a stampede though. Pets are beloved family members. A relationship with a current, trusted vet will not be easily broken. But this is a long term equation. New and younger pet owners will welcome the opportunity to care for their pets at Walmart.

Many people love their pets almost as their “children.” And there is nothing worse than a sick four legged member of the family, especially on weekends. The big winner to earn the right to be a credible pet supplier could be the veterinary clinics inside stores. The keys are reliable, credible service with an experience focused on both the pet and its owner. One great experience with the vet in-store and Walmart can earn subscription services for medicines, food and a host of accessories. The statistic that 90 percent Americans live within 10 miles of a Walmart is a huge indicator of the tremendous potential — and something Amazon can’t match.

Pet food and care is a lucrative growth category. Prescription and over-the-counter dog and cat medications were set to grow from $7.6 billion in 2013 to more than $10 billion in 2018.

By focusing on healthier food ingredients and more complete service offerings for pets, Walmart is pursuing another growth lever while bringing efficiencies to the category. I expect noted sales contribution and significant market impact within three years.

Walmart instantly becomes a player in any market, especially one like this that they already have a solid presence in. And while I see massive opportunity for them, I don’t foresee that Millennials will make up a huge percentage of Walmart’s vet/pharma business.

No one wants to spend unnecessarily on healthcare costs of any kind so making inroads in the pet prescription market could be relatively quick assuming there is marketing support in there. The clinics will take longer, but are also a good move. The spending is there and if people are willing to go to a CVS or Kroger health clinic for themselves, surely they will become accustomed to taking their pets to Walmart. That first experience will be critical in establishing expertise and building trust. The lower costs will only be the tie-breaker over other options.

The landscape of discount pet medication is fairly crowded with entrenched players like Chewy, who have gained the trust of and developed a connection with pet owners. Others like 800PetMeds have been in the space for many years with similar free shipping offers and discounts. Therefore, I don’t think this is going to be all that easy for Walmart. The first place most customers look is going to be where the customer usually buys all of their pet needs. Walmart has not developed that competency yet.

Regarding the vet clinics, pets are part of the family. They are treated just like children. So who is chosen as a vet is not always about price and a lot about trust. Sure, Walmart can get sales just feeding off the traffic to its stores, but building a long term and profitable business is going to take a while.

Many pet owners have an allegiance to their vet, and may find switching vets a little difficult. But many also complain of the cost of filling their pets prescriptions. Learning that Walmart carries a multitude of pet products and now drugs at more affordable levels will in time impact their choice of where to go. I would suspect to sell the new veterinarian. and get pet owners to switch, there will be hard promotions in-store, like those in Walgreens promoting their care clinics. All that said, I think Walmart will be very successful in this venture.

Walmart’s “all things to all people” strategy makes a lot of sense. Everyone knows where their closest Walmart is, parking is easy, and the company is curating an assortment of services that appeal to a broad swath of the population. Another win.

A yes regarding prescriptions and a not sure regarding veterinarian care. When our dog had to go on medication for Valley Fever for about six months, we discovered Costco was where to go to fill the prescription. Much, much cheaper than anywhere else. No reason why Walmart shouldn’t be in this space as well.

When our favorite, most trusted vet moved almost an hour away, my wife considered that extra driving time well worth it. But a lot of people will still be glad for local and less costly pet care. I’m waiting to see if Walmart vet clinics are, in fact, less expensive.

Reading this article I also began to wonder if we’ll see an over-medication of pets as we do with so many doctors and humans.

Ian, we also use Costco for our pet prescriptions. They’ve been a bit under the radar about this, relying on vet recommendations and word of mouth to build their franchise in this space, but you’re right, they own the discount pet medication space right now. Walmart’s move may force Costco to get a little more “vocal” about its offerings.

You are right … who knew? We discovered Costco as a source of pet meds by accident, thank goodness!

Walmart has the convenience, reach and brand recognition to do well in this space. Building these services into shops will give people yet another reason to visit and help Walmart drive footfall.

It is notable that retailers like Target have made much more of an effort with pet accessories and essentials over the past year. Walmart can do much the same off the back of its drive into pet pharmacy.

Pets are important and Walmart is a proven expert in building categories and trust, so this should be a slam dunk. As to how long it will take, that’s really dependent on the corporate rollout strategy. As to the last question, Walmart is like Amazon — focused on surrounding the customer with as many points of emotional contact and assistance as possible. Vet clinics today, family medicine practices tomorrow?

Given the number of families that have dogs, the move to an online pet pharmacy makes sense. How long it will take to implement the online service and in store clinics? That is up to Walmart management. Where will the clinics be located in stores? How will people feel about shopping for food in the same facility as sick animals?

They don’t call Walmart a category killer for nothing!

Two-thirds of U.S. households have a pet and pet products, services, insurance and prescriptions are a big spending category – $75 billion in 2019 (according to the American Pet Products Association). With pet medicine and vet care comprising half of this spending, this is a great opportunity for Walmart to drive incremental sales with its loyal customers and potentially attract new customers that are interested in lower priced pet care and medications.

Adding pet prescriptions to its pharmacy should be an easy addition, however, carving out space for a vet clinic may be a little more challenging for Walmart. Demand for these services should be high, as it will make it convenient, with 90 percent of the U.S. being within 10 miles of a store, and cost effective for Walmart’s current customers.

With the size and scale of Walmart just about anything that’s remotely “on brand” that they set their sights on will become material as quickly as they can roll it out. What’s worth focusing on is the question of for which customers and for which “customer jobs to be done” they will find success. They are virtually certain to capture customers that are buying (that is, focused more on efficiency). They won’t do well where experience is concerned, and where identifying with the brand as part of a lifestyle is concerned. Don’t expect the true, more affluent, pet parents to switch.

While Millennials are the greatest source of growth in the pet industry (pet ownership indexes at 129 — and growing), this doesn’t feel like a play to them. Their proximity to Walmart stores and bias toward smaller/local purveyors will make them reticent to consider Walmart a viable source for care of their fur baby/best friend. And their comfort with the auto-ship options of Chewy and Amazon for food is reaching into other “predictable staple” health care products like flea/tick, heartworm, skin care, etc. So the best open window is convenient, value vet visits, and proximity is not Walmart’s advantage there relative to PetSmart, Petco and the indies for Millennials.

That said, the strategy should play well as a strong value and one-stop shop benefit for Boomers and Gen Xers.

This really shows the desire to become a one-stop shop. Pet care is becoming an interesting competitive area. It creates a traffic driver into the store – the key is to be able to capitalize on it and sell the customers something they did not come in for. What will be interesting will be if they take on Petco and offer delivery of bulky pet care items to provide the “whole service.”

This play makes sense on every level, as others have already shared. And like everything else, all comes down to execution.

My take on the three key elements:

With that said, IF as part of the 500 store remodel Walmart announced just weeks ago – they take a store-within-a-store approach to pet care with a clinic + Rx + premium foods all in ONE carve-out (read: separate entrance, look and feel), it could be amazing! Throw-in some basic grooming services to complete the experience. Now that would be a statement.

I could definitely see Walmart becoming the Amazon of pet care: something cheap and easy that you can lean on without a thought.

The big challenge will be establishing trust with highly-invested pet parents and ensuring the vets have enough time to spend with each animal to give a proper diagnosis.

Best care scenario, Walmart could help make pet care more affordable to value-conscious families and, in doing so, become a destination for globally conscious shoppers who may have avoided Walmart in the past.

But I’m not taking my fur babies to Walmart ‘til I see the reviews.

I don’t think Walmart will be the place of choice for veterinary care. People simply do not leave their own vet because Walmart is offering the services. There is a confidence factor that has to be built. That does not happen overnight. But Walmart is Walmart and they are getting in another arena to wage battle. My takeaway is thumbs down for vet care. Thumbs up for all other pet related business.

It makes great business sense for Walmart. I’m not sure it will be good for pet care, though. Clearly there are low levels of service which Walmart can scale through clinics of this type. What ends up missing, though, are services which have random points at which they are critical for pet health.

Similar to urgent care clinics, these clinics will offer care which has a ceiling. Some clinicians will respect the ceiling so pets won’t get care they might need. Some clinicians won’t respect the ceiling but will offer care they’re not trained to offer.

It won’t be a massive problem for anyone. But it will degrade care.

A more apropos framework might be to inquire for the number of untapped markets that would succumb to price leveraging market share for consumer recognized product and/or services to levels of profitability. This could lead to creating discovery methods to unveil viable markets that would be readily persuaded to inquire and participate in new programs, with little or no live market testing. Use of real intelligence recommended.

I think Walmart is well-positioned to win big in this category and become a top-three purveyor of pet products and services, just as it has in the prescription eyeglasses category.

The playbook was written roughly 28 years ago. It was at the peak of the one-hour optical boom then led by Lenscrafters and Pearle Vision. Sam himself recognized there was an inviting space beneath the padded margins then common in the vision care category. Today Walmart Vision Centers is the third largest industry player, with 2,900 in-store locations.

I see many parallels with the pet sector, which is dominated by Petsmart and Petco which have more than 3,000 locations between them. Both chains combine a mix of product sales, medications, pet services and on-site veterinary clinics. Margins are fairly rich, which must look tempting to the retail logistics masters in Bentonville.

Fold in a bit of digital innovation (an area where the top pet chains seem to be active but conventional) and Walmart stands a good chance of disrupting the entire category.

Smart move for Walmart, who is finding more and more ways to integrate into the lifestyle of their customers.

Given the scale that Walmart offers across all their businesses, it is inevitable that they will become the category killer for pet prescriptions as well. They offer a clear financial benefit and have the benefit of very frequent store shopping for their core customer segment as a base. I imagine they will offer store delivery of prescriptions as well as home delivery, further driving traffic, and expanding their offerings into higher margin categories of the pet business. Many people will spend more for their pets and I am sure this will prove a profitable venture for them.