Photo: Magic Spoon

Will Americans eat a direct-to-consumer cereal brand for breakfast?

You may have noticed if you’ve walked in a supermarket lately that the space dedicated to cereals isn’t what it used to be. That’s because consumption of ready-to-eat cereal has dropped significantly over the years as consumers grab more convenient and/or healthier options (think yogurt, protein bars, McD’s drive-thru) when rushing to work and school in the morning.

While consumption is down by double-digits over the past decade, that still leaves a pretty big market, and one brand, Magic Spoon, is looking to bypass grocery store shelves altogether and sell its cereals directly to consumers.

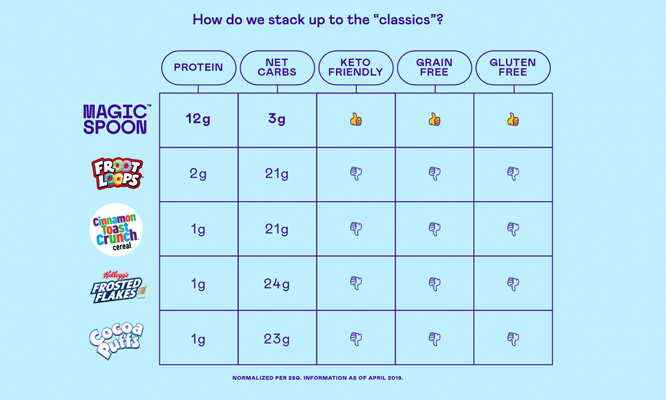

Magic Spoon offers four o-shaped cereas flavors — Cinnamon, Frosted, Fruity and Cocoa — that are touted as being high in protein (12 grams per serving), low in net carbs (only three grams) and free of artificial ingredients. The brand sells its cereals in cases of four boxes at $39 a pop. Each box offers seven servings. Order two cases and get delivery free.

The number of categories — beauty, mattresses, shaving, etc. — that have been disrupted by consumer direct brands continues to grow. This, Magic Spoon co-founder Gabi Lewis told Adweek, has helped smooth the way for his brand.

“People have been primed the past several years to buy new and exciting products online,” he said. “There’s such a dearth of good options in the cereal category. And it’s a category that people grew up with and loved so much that they’re really excited to find something that’s a reinvention of what they know as cereal.”

Discussion Questions

DISCUSSION QUESTIONS: Do you think Magic Spoon will catch on with large numbers of consumers? How do you see the brand’s business changing — expanded product lines, selling through other channels, opening physical locations, etc. — as it goes along?

Somewhere between failure and epic failure. Their comparison chart uses some of my favorite cereals (yeah Cocoa Puffs!), but not any cereals that might be good for you. My wife eats Kashi GoLean every day. It also has 12g of protein, albeit lower in net carbs. They don’t mention sodium counts and the grain and gluten free aspects are not necessarily a positive. Take that along with a price that’s about triple the grocery store price of something like Kashi and I think your market is extremely limited.

My first rule is you can’t sell food products if they don’t taste good. So, without actually trying the product, it’s hard to evaluate its potential. Also, it seems a bit troubling that there is no comparison — or mention — of sugar content, one of the key ingredients leading to the decline of breakfast cereal consumption among those hearty few who still eat breakfast at home.

That said, assuming it tastes good, and assuming it is not loaded with sugar, the only other obstacle to success seems to be the pack. Who keeps four boxes of the same cereal in their pantry or cupboards anymore? Now, if the question is, “Will people buy cereal direct?” I think the answer is, “Why not?”

If the launch works after all of the above caveats, it will inevitably add (too many) lines/line extensions and could eventually be sold in physical stores as well. But, at this point, that’s a lot of “ifs.”

Totally agree! It has to taste good first and foremost and the price point gets me too. If they meet the needs of the consumers, sure, they can sell direct. For my 2 cents.

Kudos to Mr. Lewis for trying something different. But I don’t see the level of product differentiation justifying a hefty price tag for seven servings of cereal. And cereal in the online environment is hardly a new thing. This looks like a very heavy lift.

4 boxes of cereal for $39. We all know how this is gonna end. Not very well, unless every rich family with kids all step up and buy these products.

Does cereal need to be disrupted with a DTC play? Often times the disrupted markets are overpriced and the upstart DTC comes in at a lower price point with added value. Here it seems the price advantage isn’t there so there would be a hurdle to overcome for a consumer to want to try the cereal without committing to buying 4 boxes. Assuming customers find it tastes good, will they want to stock multiple boxes of this cereal at a time? I’m not so sure. It’s interesting to see if the cereal market can be disrupted this way, but I suspect a different subscription model will be needed to scale.

I can’t imagine Magic Spoon as a big hit when consumers are looking for good value among all food categories. We’re constantly comparing prices at Whole Foods to other grocery stores. How does Magic Spoon avoid that comparison?

Clearly a cereal that is targeted at adults (and likely those without kids), so selling 4 boxes at a time to customers who are buying for themselves or maybe 2 people in the household seems to be a disconnect. It puts consumers in a tough place — eat the cereal every day and get burnt out on the repetitive meal, or have it occasionally and let it get stale.

That said, I can see this brand gaining popularity in very niche groups and up-scale/hipster breakfast joints, but I don’t see mass market success in its future.

I just want any of the major players (e.g. General Mills) to offer a monthly/quarterly subscription box of discontinued cereals (with original packaging design) from days gone by.

Magic Spoon’s approach to cutting out the middleman (grocers) is a concept that CPG companies are experimenting with and it may make sense for some products. However, Magic Spoon has a big challenge — price! It is way too expensive at $39 for four boxes of cereal and they also charge another $4.99 for shipping. While this may be a failed attempt at this concept, other more reasonably priced products could be very successful with direct to consumer and subscription service cereals. Families with several children go through an enormous amount of cereal and if they can get on a scheduled replenishment program (with free shipping), it might be a winning strategy.

$10 for a box of cereal that no one has ever heard of, that differentiates well against junk food cereals but not at all against healthy choice cereals and that only sells in 4 pack cases with no free shipping?… That kind of hefty pricing on a D2C without a middle man smacks of purposeless greed. I hope they fail fast for their sake!

The price knocked me for a (fruit) loop! It’s a niche market play at best.

So the only option is to buy 4 boxes (28 servings @ $39, more than a dollar-per-serving)? I think I’ll pass. And I think everyone else will as well.

Not convinced this brand will make a significant difference in the market. True, the center of store is shrinking for a variety of the reasons mentioned. However, the established brands recognize the erosion due to the movement into online and are course correcting as consumers’ shopping options are changing, albeit not as quickly as needed.