Photo: RetailWire

How long is the customer journey?

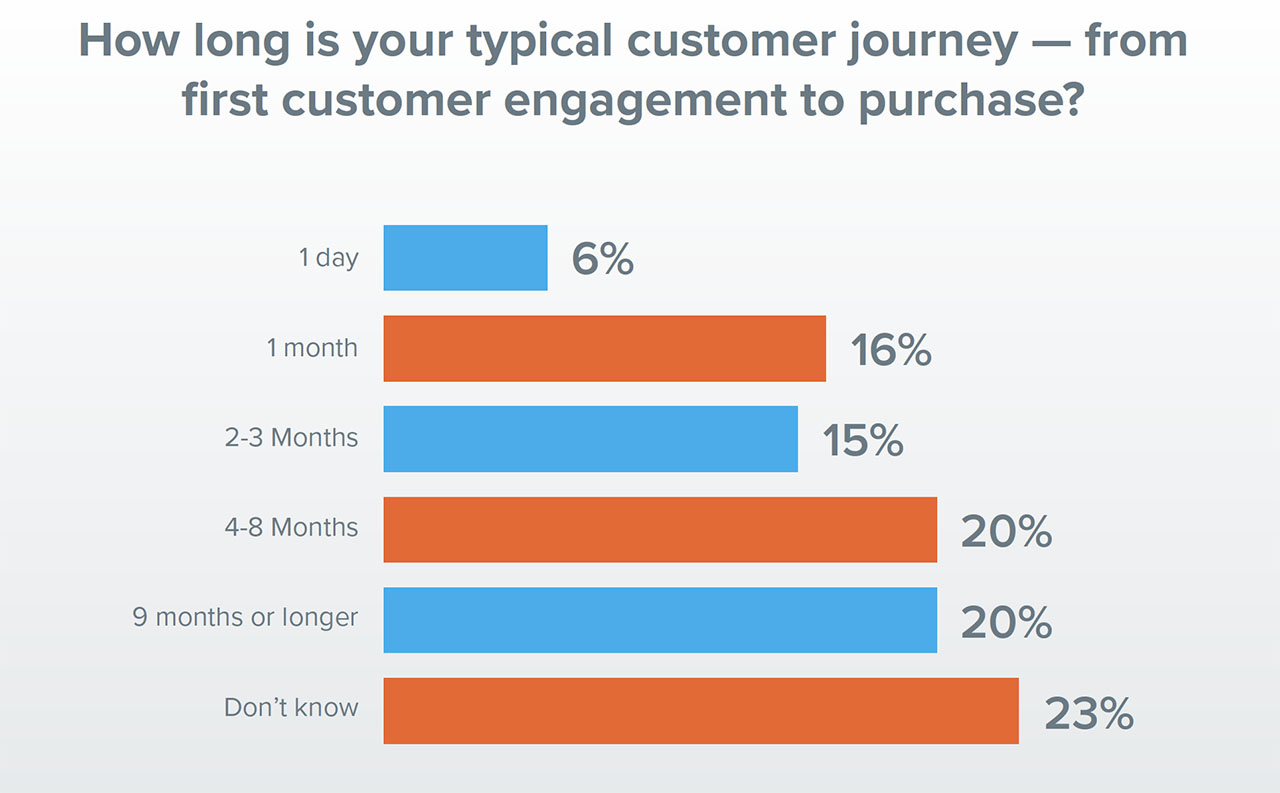

In a survey of 158 business professionals by Arm Treasure Data, 71 percent say they believe the time between first customer engagement and purchase is a month or longer.

About a quarter (23 percent) didn’t know how long their typical customer journey was.

The survey infers that the journey has become lengthier because of the increasingly multichannel nature of shopping. Sixty-one percent of respondents indicated customers typically engage with their brand three or more times before making a purchase. For 15 percent, the number of touchpoints prior to purchase is 11 or more.

BRP’s “2019 Consumer Shopping Survey” released in April suggests that the customer journey is evolving as consumers move across channels to research, purchase and review products with easy access to merchandise and information on mobile devices.

Among digital consumers (ages 18-37), 65 percent in the BRP survey said they want the ability to receive personalized recommendations, and 65 percent prefer the ability to pay via a mobile wallet or retailer app. Same-day delivery was cited by 77 percent as a reason to choose a store. Digital consumers were also found to be more likely than traditional consumers (ages 38+) to share feedback on social media for both exceptional and unsatisfactory shopping experiences.

Wunderman Thompson’s recently-released “Future Shopping” study found search engine dominance shrinking during the inspiration phase of the shopper journey but social media gaining. In its survey, only 36 percent of Gen Z shoppers (ages 16-24) said they turn to search engines for inspiration versus 51 percent of overall survey respondents. Half of Gen Z look for inspiration on social versus only 32 overall. Thirty-six percent of Gen Z respondents seek inspiration on brand websites and 28 percent in-store — similar to all consumers.

However, when it comes to actively searching for individual products to buy online, 56 percent of consumers go directly to Amazon to start their search. That tops search engines (49 percent), brand websites (29 percent) and retailers (27 percent).

Discussion Questions

DISCUSSION QUESTIONS: Have typical shopper journeys become longer or just harder to determine? How have the changes to the shopper journey challenged retailer and brand approaches to targeting, attribution and overall mapping?

The question is not how “long”, but how many connection points are there in the journey. The real tough question for retailers is to develop a cost effective strategy to connect on the relevant touch points that they can leverage.

Averages are interesting, but not particularly helpful. There will be enormous variation depending on what’s being purchased and why. Something like a car or expensive furniture may have a long lead time. Apparel is likely to be significantly less. What is certain is that people do more research and take longer to buy than they did 10 years ago, and they use more touch points. That means there’s a lot more areas where retailers need to reduce friction.

This is a sort of bizarre question. I mean the true answer is “It depends.” There are items we just buy, because they are, as my friend Nikki Baird describes them, “low consideration items.” Higher consideration items (which by my definition are ones that are all around higher priced and have more important utility) certainly have a longer path to purchase.

Is it longer than it used to be? It might be shorter, really. After all, we can find out a lot more about products more quickly than in pre-internet days. But it is certainly a chaotic process, meaning it’s random. Back and forth between digital and physical channels. Then there’s fashion, which is very bifurcated, with fast fashion being just that – fast, and things like jewelry, or more expensive wardrobe “staples” taking longer.

Retailers need to have consistency across all touch points, as Chris points out. Beyond that, I think we just have more data than we used to. And don’t assume you need to drop prices to goose the process.

Yeah – totally agree. The question is too broad. It depends on what’s being purchased.

For Staples, it has become shorter due to innovations like one-touch ordering. For more complicated items like consumer electronics, it might be longer as a consumer can not only research more but then can continually browse various sites to determine the best deal, read reviews, and compare options.

Good points, Paula. The real challenge for brands and retailers is the increasing consumer options due to the enormous amount of information that consumers have at their fingertips. What we have is a more complex journey with dynamic offline and online connections that zigzag brands, stores, social media and search platform boundaries with speed and ease while ranging from minutes to days and weeks. Time and complexity are very much related to the “low and high consideration” calculus that Paula (and Nikki) defined. Even then, a low consideration item for one person may be a high consideration item for another. In the shift from a product-centric model to a customer-centric one, there are no shortcuts or silver bullets.

I think what is missing in the article is the differences in category and price points. Indeed, a consumer interested in purchasing a high-ticket item such as a new flat-screen TV or appliance is most likely going to spend significant time researching online and possibly browse stores. However, there is still a high percentage of shoppers who like stores and, yes, even malls, who will check out a store simply because it’s new. Then when impulse buying kicks in, which is often in the brick-and-mortar world, they’ll make a purchase.

All this data and information is excellent, but I caution retailers that have stores not to lose sight of A.) how to increase traffic by using effective advertising and B.) doing everything right to help the customer make a purchase once traffic is in the store.

Use technology wisely to improve your business but not to replace the basics that are vital to your success.

I look at it through the lens of knowns and unknowns. For knowns, for replenishment or replacement purchases, I have to believe the journey is shorter. A couple of clicks and you’re done. For unknowns, where some homework and research is called for, I have to believe the journey is longer, maybe much longer, and maybe to the point of too much information. Retailers and brands have to be more succinct and focused in their communication than ever.

Clearly biased towards higher-priced items. Most of what we buy day in and day out is grocery and there’s probably a trivial, if any, purchase journey there.

The path to purchase is as dynamic as ever as we are dealing with a channel-less consumer who wants to shop, engage and buy on their own terms. It’s extremely challenging to make a broad generalization about how long the customer journey is, as it varies significantly across every retail segment.

It’s clear that an optimized digital experience will lead to broader brand engagement, as well as the potential to draw the consumer to the physical stores or showrooms. With the emergence of the shop now capabilities on Instagram, and the Amazon marketplace the path to purchase is only increasing in complexity.

The traditional customer journey maps are things of the past. It’s the digital-first consumer that is driving the market to become more agile, flexible, responsive and adjust the strategies to the new customer journeys.

The length of the journey is highly dependent on the category. FMCG/apparel, etc. have shorter lead times vs. durables like electronics, etc. which could be one month or even longer.

What do we know:

What is hard to determine:

This very much depends on the product and the single biggest factor is the overall price – the bigger the investment the longer the journey. Compare a car to a new power cable for your phone.

However as consumers become more informed they are getting longer and undoubtedly more complex. Myself and my colleagues have done a lot of work helping retailers map customer journeys using input from process mining in order to identify points of friction that can be improved. Often a point of friction for the customer is also a hidden cost for the retailer so it is critical to understand from an outside-in as well as an inside-out perspective.

I agree with the previous comments that this question (as can be shown by the wide variance in answers) is much too broad. Industry or product specific research would be much more helpful, and if I were running it I would be interested to see if there was a difference in the shopping cycle based on where the journey began – i.e. do consumers who begin their interactions on social channels have a quicker turnaround time than those starting from search engines or in-store?

As customer expectations have changed due to additional shopping options with more competitive pricing, greater merchandise assortments and faster delivery to get the desired product where and when she needs it, the customer journey has become more complicated and varied than ever before. Consumers now start and stop their shopping journey in different channels, including online marketplaces and social media, and frequently shop for the same product across different retailers, both online and in the store. The path to purchase varies by consumer and type of product being purchased so it is difficult to determine.

Consumers expect a frictionless shopping experience across an entire brand and they don’t want disruptions as they cross individual channels or locations. Consumers also expect their experience to be seamless as their “shopping cart” and browsing history follows them throughout their journey. To adapt to this expanded shopping journey, retailers must transform their customer engagement models.

As retailers shift to operating as a platform (Lululemon being a recent practical example), the journey is not and should not be thought of as linear.

I know this may make me sound like the old philosopher, but the duration of the shopper journey is life-long. It’s an endless meander with numerous stops, starts, influences, diversions and decision points along the way.

Too many product marketers seem to begin their analyses at the end point (a sale) and work backward as if the path to glory was a linear one. That leads to a skewed and oversimplified perspective, I think.

There are some high-consideration purchases, to be sure, that shoppers begin with “I want/need a…” (fill in the blank: new flat screen TV, outfit for a party, holiday turkey) and pursue a single-minded shopping process. Those decisions are always influenced by pre-existing brand biases, prior experiences, ads, reviews, recommendations and self-image.

Low-consideration purchases, like grocery and household products, may seem perfunctory, but in fact the influences may go back to what our parents’ preferred, or maybe a series of direct product experiences that date back years or even decades.

Marketers often have no way of knowing about these powerful forces, or how they may be limiting or magnifying their ability to influence individual shoppers. Research may sometimes reveal useful patterns of habit or other insights — if they apply to significant groups of consumers. Current marketing tactics, especially personalized marketing through digital channels, may bring influence and discovery to brand marketers, but this too is a long game. Always has been. Always will be.

The comments in this topic have hit upon the most obvious point that product matters in the duration of the shopping journey. That said, others have also mentioned that one-click buying has hastened the journey even for some typically longer-term journey categories. Remember, you can buy Teslas online. It only takes two clicks to get to the “Buy” button on their site. So, convenience has something to do with this topic, also.

I am joining this discussion later in the day today and I see some common themes from the RetailWire Experts. Price points do matter and the more expensive the purchase, the more research (meaning independent sources AND social opinions) are necessary for the consumer to feel good about the purchase. However, I don’t know that we can equate number of sources to the length of time to purchase.

The idea of “frictionless” consumer understanding and shopping is also key. I like the term “seamlessness” across bricks, clicks, social media, etc. for the consumer to be satisfied about a purchase. My personal feeling is frictionless or seamlessness will become less and less generational because of mobile devices.

Here is an example. Last week my wife, my 17 year old and I were shopping in some little boutiques in a nice little town in Minnesota. My 17 year old spotted a great coat from a Swedish company. The owner of the boutique was very helpful with sizes and colors. However, my son wanted to wait on the purchase, so we headed to have lunch. At lunch he immediately took out his phone and Googled the company looking for other colors, checking price points, etc. End of the story … after lunch we went back to the store and bought the coat. The price online was cheaper, but when you factored in shipping and wait time, it was a no brainer to buy at the boutique. The amount of time from seeing the coat (potential impulse) to actual purchase was lengthened because of research, but it was a seamless process and no buyer remorse.