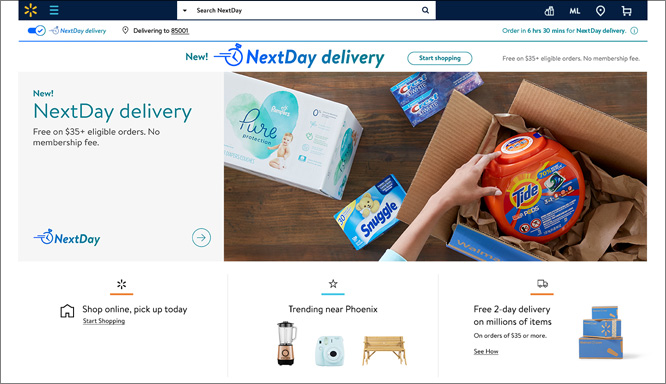

Photo: Walmart

Did Walmart just one-up Amazon on next day deliveries?

No one expected that Walmart would stand pat after Amazon.com announced last month that it was cutting its standard two-day delivery time for Prime members to a single day. Now, the world’s largest retailer has issued its initial response with the announcement that it too is rolling out next day deliveries — no annual membership required — to about 75 percent of American consumers by year’s end.

Walmart said its NextDay delivery program for online orders will start in the Las Vegas and Phoenix areas today followed by Southern California before being expanded to 40 of the top 50 retail markets in the U.S. Initially, about 220,000 of the most frequently ordered items online, including consumer electronics, diapers, laundry detergent and toys, will be eligible for next day delivery. Free deliveries are available on purchases of $35 or more. Assortments will vary depending on location.

The retailer also emphasized that it beats next day deliveries with its various buy online pickup in or outside the store services as well as its same-day delivery of groceries in select markets. Walmart.com will continue to offer free two-day delivery service on eligible items not included in its new NextDay service.

“Our new NextDay delivery isn’t just great for customers, it also makes good business sense,” wrote Marc Lore, president and CEO, Walmart eCommerce U.S., in a company blog. “Contrary to what you might think, it will cost us less — not more — to deliver orders the next day. That’s because eligible items come from a single fulfillment center located closest to the customer. This means the order ships in one box, or as few as possible, and it travels a shorter distance via inexpensive ground shipping. That’s in contrast to online orders that come in multiple boxes from multiple locations, which can be quite costly.”

While much of the attention has been focused on the convenience competition between Amazon and Walmart, Target has not been standing idle. The retailer offers free two-day shipping for online orders, same-day delivery with its Shipt service in 46 states, Drive Up fulfillment at over 1,000 stores, in-store pickup and Target Restock next day deliveries in major metro areas, including Boston, Chicago, New York City, San Francisco and Washington, D.C.

“Target is, hands down, America’s easiest place to shop,” said Brian Cornell, Target CEO, on the retailer’s fourth quarter earnings call in March.

- Free NextDay Delivery Without a Membership Fee – Walmart

- Should (can) rivals meet the free one-day delivery bar being set by Amazon? – RetailWire

- Target crushes it with strongest holiday results in years – RetailWire

- What will it take for retailers to win the last-mile race for customers? – RetailWire

Discussion Questions

DISCUSSION QUESTIONS: Do you find Marc Lore makes a compelling business case for Walmart’s move into next day delivery of online orders? Is Walmart keeping pace or taking the lead against Amazon and Target when it comes to consumer perceptions of shopping convenience?

Love it! This is going to be expensive for Walmart. Yet when Amazon is increasing its price for Prime, a good place to go is to offer the same service – but without the Prime membership fee.

Walmart needs to start super-emphasizing its BOPIS and BOPOS (buy online pickup in-store/outside-store). This is still Amazon’s weak spot. Then customers can even do better than next-day delivery. BOPIS lets Walmart do same-day or four-hour delivery.

Physical stores provide Walmart with the distribution advantage and they’re making the most of it. Walmart was not going to allow Amazon to get the competitive edge with one-day delivery, so their response was somewhat predicable. While Amazon still leads the pack with perceptions of convenience, Walmart is a formidable competitor that is willing to do what it takes to maintain/grow its position. Target is in the game, but a half-step behind in my estimation. Virtually everyone else is an also-ran.

One day, two days, I’m not sure that’s the key button to push anymore, especially with the proliferation of BOPIS, which is essentially less than one day. There are four Amazon warehouses in our neck of the woods and if I order simple stuff like books, music or certain tools/supplies, I get them the next day anyway and sometimes the same day without even asking. In other words, I’m already trained to get just about anything incredibly fast.

Pushing one day as a big reason to shop Walmart over Amazon is a solid “meh” to me in terms of brand benefits. Maybe it’s Target they’re after, who’s in the Dark Ages of fast delivery. But that’s another story.

Unlike a few years ago, Walmart is now really flexing its muscles when its comes to e-commerce, and that’s a good thing for competition and for consumers. Walmart’s store base and strong logistics capabilities give it a potential advantage in fulfillment that means it should be able to offer speedy deliveries at a much lower cost than many rivals. For me the challenge is less about logistics (where I think Walmart can succeed), it is about persuading more customers to use Walmart as their default e-commerce site. Customer numbers are growing, but there’s a lot more work to do.

Likely this has been in the works for a while. Although it always feels like Marc Lore wants to stick it to Jeff Bezos in any way possible, this is too much of a commitment to have been knocked together just as a response to Amazon’s move.

The devil is in the details regarding how good this program will really be. “…eligible items come from a single fulfillment center located closest to the customer.” How many “eligible items” is unknown and will determine if this is just headline fodder or a real program.

As the Amazon/Walmart duopoly pulls away from the pack and consumer expectations morph from two-day to next-day deliveries, Macy’s, Nordstrom, Target, et al, will have to bite the bullet and go that direction too. My concern is for the smaller retailers, mid-size to mom-and-pop that financially and logistically can’t go there. If they haven’t already, they really, really will have to position their brand and value add so that shipping (and probably price too) is not the reason for shoppers to support them. Or else …

The battle for delivery has more twists and turns than Game of Thrones. Drama. Sudden shifts. Royalty. Money. After all, dominance over the kingdom is at stake. OK, maybe that’s a bit too dramatic, but perhaps no less important. What does all this mean? The actions to win significantly impact those further down the supply chain. 1.) Packages will arrive faster than ever before (assuming you live in the right Kingdom, oops, zip code). 2.) Brands selling via e-commerce must become more nimble than ever with regards to their own supply chain. 3.) Shopper expectations for “I want it now” will only increase which will have broader implications across retail (online and in-store).

There is no doubt that today we are living in a world of instant gratification. We have gotten ourselves into somewhat of a frenzy with how fast product can be delivered. I question in the overall picture if the difference of one day versus two days matters that much because we are also so busy. We tend to get to things including merchandise ordered when we have time. How many times has the package arrived and it sits on the desk or table in another room for a few days until you have the time to open it? The retailer spent extra dollars getting the package to you as soon as possible. To me the product quality matters most, the cost and of course the service. Delivery is essential, but I don’t think the fastest speed possible is as important as many people are saying. I wonder how many valid studies have been done to determine if the difference of a single day for delivery matters that much. I’d rather see businesses investing in what will help sell merchandise like trained staff when it’s a store and slicker and easier navigation when using online services.

It is clear that the speed-to-market fulfillment battleground is where winning is done. Despite all the press around the Amazon Prime value proposition, Walmart and other retailers are competing in the next-day delivery space, and its a place to win the hearts and minds of customers.

The main distinct competitive advantage that Walmart has to capitalize on is not only leveraging its big box locations as pickup fulfillment centers for next-day delivery, but finding creative ways to fully maximize their BOPIS capabilities for same-day pickup. Not only will Walmart win the speed to market race, they could potentially attract customers to their stores so they can offer them incremental products or services.

The challenge is for Walmart to provide easy ways for customers, who only want to pick up products, to navigate their big box stores by establishing a separate and easy-to-access BOPIS pickup section. It will be interesting to see how all of this plays out.

The key word here is “free.” As Amazon continues to hike its Prime membership fees, Walmart’s next-day program drives major distance and differentiation. Target may not be standing still but determining which convenience options are available where is still baffling. Here again, Walmart gets points for its quick rollouts and awareness campaigns (which have ramped up as of late). Shoppers shouldn’t have to play guessing games regarding which regions or store clusters offer various pick-up or delivery options. If shoppers don’t know about convenience options, they might as well not exist.

Combining multiple items into one box and transporting shorter distances certainly has some efficiency and cost benefits for Walmart. With stores as distribution centers across the nation (within 10 miles of 90 percent of the population) Walmart has an advantage over Amazon from a speed of delivery perspective. However, if more people opt for free one-day delivery, it will start eating into Walmart’s margins. Without a membership fee to offset these costs, Walmart may need to adjust prices or charge at least a nominal delivery fee.

The shipping/delivery game is heating up and it will continue to raise the bar on consumer expectations.

Looking at next-day delivery from a psychoanalytic perspective (I am not a psychoanalyst), next-day delivery seems like one step closer to a neurotic, gotta-have-it-now mentality that makes people stress out. It is not the answer to living a stress-free life.

It is disappointing to watch behemoths engage in a competitive “race to the bottom” to see how much they can give away to consumers. Do consumers win? Only in the short term.

Next-day delivery is a premium service (as is buying online). But rather than pay attention to economics, they seem to be paying attention to a press clipping war and raising expectations among consumers to a point they’ll not be able to support in the long run.

This just may be a Pyrrhic victory for whichever company gets more sales as a result.

Buying online is a premium service? Maybe in 1999 I would have accepted that statement. Sorry Doug, it has been a standard practice for well over a decade.

So… You’re telling me it’s healthy that retailers have spent decades removing margin from product to an unsupportable point. And we should applaud them giving up any margin that’s left? It’s a death march.

No matter how much time passes, for me to sit in my living room and order and have it show up at my door (whether fast or slow) is a premium service. It’s only because Amazon (with the press aiding and abetting) has claimed it’s “normal” that there’s any risk at this point.

But economics are economics. What’s premium is premium — even if stores lack the backbone to say it straight.

Doug, you are entitled to shop any way that you like, but e-commerce is mainstream and standard whether you believe it or not. Reinterpreting my comments to something about margins is out of context and won’t change that fact.

Every purveyor makes their own choices by which channels they sell and at what margins. Sears and others built substantial businesses more than a century ago on catalog sales. The internet is the mainstream catalog of contemporary times. Amazon did not pioneer e-commerce (in fact, Sears blew their chance to be Amazon), and you give Amazon far too much credit in determining what other businesses do and how they profit trying to keep up. Amazon is outcompeted constantly by online-only businesses that know how to attract and maintain sales by defining their market and value proposition in a way that suits their customers. You can claim that all or a significant number are eroding profits chasing Amazon’s tactics (some are), but where’s the data?

I’m a bit surprised that you’ve taken my comment that consumers should pay a premium for premium service as “opposition to online shopping” or denial that it’s here to stay.

Of course it’s here to stay. But I’m reminded of a friend of mine (VP marketing for AT&T Wireless) who expressed dismay at how in the U.S. phones were given away and the future chaos that would create for them. He was right. And now Bell South (the new AT&T) is attempting to change that policy and have consumers pay for their phones.

As to Amazon, they spent $27 billion with a “B” shipping things last year. It appears that Amazon Prime is merely a way to lose more money, faster, on retail-like sales. The evidence is pretty clear in their annual reports once you remove AWS as well as estimates of content and their own devices. They are creating a future disaster for themselves.

Back to my point: A dash to the bottom leads to no one winning. The theory that a money loser can become profitable by losing more money is clearly not legitimate. Retailers should start charging for premium things.

On paper, Walmart’s free one-day shipping seems like a great answer to Amazon Prime’s $10.50/month one-day shipping promise. However, where Walmart falls woefully short of Amazon is localized inventory and assortment management. The “fine print” indicates that Walmart will offer free next-day delivery on its most-ordered 220,000 items. The theory being, I suppose, that when you combine free one-day on these 220,000 items with free BOPIS and free ship-to-store on everything else, Walmart believes they have covered all their fulfillment bases. My experience, however, tells me otherwise. Far too many items I seek are only available with seven- to 10-day delivery windows, while Amazon is always there with one- or two-day options. Walmart needs to close these inventory and assortment gaps if they intend to truly stay competitive with Amazon.

The Walmart move, while a potentially good one, is still a “me too” or two. Amazon sets the bar for innovation in many areas, including logistics. Walmart and Target are still trying to catch up. Although Amazon has expanded its store pickup with the acquisition of Whole Foods and has made returns easier with the Kohl’s partnership, nevertheless Walmart has a terrific brick-and-mortar infrastructure that has not been fully engaged for pick up and/or returns. Improvements in this space can provide differential advantage.

Marc Lore’s business case is compelling. Fulfillment centers close to the consumer, sending in one box, and using ground shipping are all things that should make Walmart’s fulfillment process less expensive. Walmart is taking the lead on fulfillment along with Target because they have stores for BOPIS and for fulfillment that Amazon does not have except for Whole Foods stores.

There is the stated capability and then there is reality. I find more than a few of my Amazon two-day deliveries don’t actually achieve that standard, even if on check out it indicates the exact date. I’m for consistency and meeting expectations. If I want something that much that I can’t wait at all I’ll combine health and gratification and actually walk to pick up the product the old fashioned way.

So many wrinkles to this move in the speed-of-delivery chess match between Walmart and Amazon:

First, I feel certain that the next-day promise from Walmart was not a knee-jerk response to the Amazon announcement last week. Certainly the counter-measure has been long in the works, waiting for the right moment. Lore and Bezos are both playing several moves ahead.

Second, it’s worth remembering that Walmart provides “right now” fulfillment for any purchase made in-store, a service standard that Amazon cannot match. (Of course the item needs to be in-stock, but that’s another story…)

Third, unless you’re sending a ready-to-eat meal or urgently needed medicine, speed of delivery is a service distinction without much of a difference. Once the shopper is waiting, they are waiting. Rarely does another day or two actually matter in any practical sense.

Fourth, consumer survey responses on this topic are highly suspect and subject to confirmation bias, in my opinion. Shoppers naturally say that faster is better, but once we put a price increment to that experience, the picture changes. In this regard, Prime membership allows shoppers to disassociate the sunk cost of the delivery system. Rather brilliant on Amazon’s part!

This is what I love about competition. When someone steps up with something new and innovative, it forces everyone to step up (if they want to keep up). That’s what’s happening here. If anyone can take on Amazon’s one-day shipping, it’s Walmart. This is good for the consumer. As the old saying goes: The rising tide lifts all boats!”