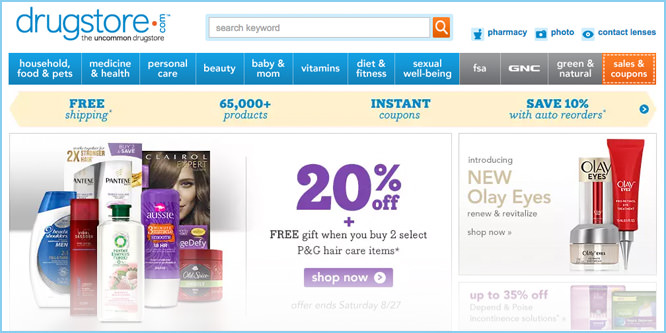

Source: drugstore.com

Did Amazon bring down Beauty.com and Drugstore.com?

Through a special arrangement, presented here for discussion is a summary of a current article from the Retail TouchPoints website.

In an effort to put more focus on its own e-commerce web site, Walgreens recently announced it will pull the plug on Drugstore.com and Beauty.com. The pharmacy retailer acquired the two websites for $429 million in 2011. While the shutdown will cost Walgreens $115 million, according to a regulatory filing, the move is likely to help the retailer cut costs in the long run and to enhance its omnichannel strategies.

When considering the competition these pure-play websites faced with Amazon’s massive marketplace and Prime advantages, it’s not surprising that Walgreens made the decision to shut them down. And the company is not alone. In January 2016, Target quietly nixed two online culinary companies it had acquired in 2013: CHEFS Catalog and Cooking.com.

Walgreens has already taken strides in enhancing its digital initiatives. The retailer recently announced it will offer paperless coupons that can be “clipped” from product detail pages on Walgreens.com and the Walgreens mobile app.

“Over the past year, we have been focusing on building new omnichannel capabilities on Walgreens.com with initiatives that improved assortment and web site user experiences, enhanced our digital coupon capabilities to provide more customer value, and added digital tools into our stores to elevate our shopping experiences,” said Phil Caruso, a spokesperson for Walgreens in a statement. “Expanding on these efforts is an important part of our strategy.”

Discussion Questions

DISCUSSION QUESTIONS: What do you think drove the closure of Drugstore.com and Beauty.com? Has it become more challenging for retailers to operate category-specific websites with omnichannel’s increasing demands and the importance of scale?

Operational efficiency and omnichannel strategy drove this decision. Operating a large brick-and-mortar entity (and its associated tentacles) is a daunting task. Add to that the complexities associated with a solid online and mobile presence, and it becomes a matter of focus. Walgreens needed to not only ensure a seamless shopping experience for the shopper (consistent content, inventory and processes), but also build scale to compete. And I believe that doing that through competing platforms simply became too arduous for Walgreens.

Did Amazon play a part of this? Perhaps. Had Walgreens known of Walmart’s acquisition of Jet.com, their decision to consolidate under one banner for a stronger online presence and more streamlined reach would have been even easier.

How many consumers are going to miss Cooking.com or Drugstore.com? The sites had good potential and great, easy-to-remember URLs, but in the hands of brick-and-mortar retailers, failed. Both Target and Walgreens have had difficulties finding their digital footings. In the hands of an e-commerce master, both would probably have succeeded.

The Retail TouchPoints headline — “Is Amazon To Blame For The Demise Of Beauty.com And Drugstore.com?” — is kind of silly. Assuming blame isn’t pejorative, the one to blame is the consumer. With today’s online consumers it is all about time and convenience. Why would I have a stable of websites to go to for each category I shop when I can go to just one and find exactly what I need?

In the last couple of weeks, my wife and I made a number of single purchases from Amazon. Each purchase was made independently and only one item was purchased. They included a part for the dishwasher, ink for the printer, a book, lipstick, a skin care item, another skin care item, an umbrella, a streaming movie and a birthday present for my granddaughter. Neither of us went to the umbrella site, nor the beauty site, nor the ink site, nor the movie site. Everything that we wanted could be accessed in one place. As my granddaughter says, “easy-peasy.”

These closures represent the continuing evolution of online shopping to a convenient, seamless experience. This experience must be as good as other options on the Internet. While Amazon did not cause the demise of these category-specific websites, it is now the standard that all online shopping is compared to.

Remember, omnichannel is not about channels. It is about your customers and how they interact and access your products and services. It is about robust order fulfillment strategies as well as better mobile experiences (customers can now manage their points and offers via mobile). These are the outcomes that Walgreens and Target are striving to achieve in their revamped online strategies.

It would be easy to give Amazon all the credit, but who knows. No doubt big A was a factor, but there had to be other causes too. When there’s cash at hand it seems easy to buy into a market but, given lots of factors, an acquisition is a starting point, not an endpoint.

At the very least, to attract customers who have been influenced by the environment set by Amazon, execution at all levels is crucial. In other words, UX, UX, UX.

I think the consumers made the decision by choosing where to browse and buy. As independent pure plays, there was value to building a third party presence with content and direction to the brand. When you are owned by Walgreens, the brand equity doesn’t translate. If you want to drive business to Walgreens’ brand and store, then walgreens.com should be the single portal. It doesn’t make sense for Walgreens to invest in two additional category-specific brands to do the same thing.