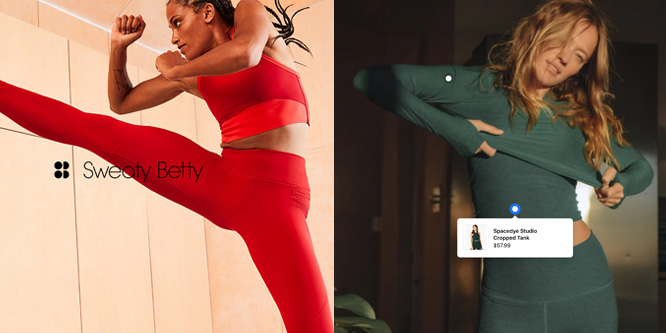

Sources: Sweaty Betty; Beyond Yoga

Can Sweaty Betty and Beyond Yoga take on Lululemon?

Wolverine Worldwide last week acquired Sweaty Betty and Levi Strauss agreed to purchase Beyond Yoga as both enter the burgeoning women’s activewear category.

Sweaty Betty has 65 stores in its home base of the U.K. and Hong Kong and is expected to generate about $250 million in revenue this year. The women’s activewear brand expanded into the U.S. in 2013, but closed all 12 stores during the pandemic. Its products are still sold online and inside Nordstrom locations in the U.S. Online sales make up about 70 percent of sales.

The $410-million purchase is expected to help Wolverine, a major footwear supplier with brands including Merrell, Saucony and Sperry, accelerate its direct-to-consumer push, particularly online, expand internationally and diversify beyond footwear.

Wolverine told analysts on a call that the global activewear market is growing mid-to-high single-digits with the premium women’s portion approaching double-digit growth.

“The market segment is benefiting from several established macro trends, including consumer focus on health & wellness and casualization,” said Brendan Hoffman, Wolverine’s president on the call. “There is also an ongoing trend towards more premium products, incorporating higher-quality materials, cutting-edge innovation and design, and sustainability. The confluence of all these powerful trends is contributing to Sweaty Betty’s accelerated growth.”

Levi’s likewise sees Beyond Yoga capitalizing on “the continued consumer uptake of premiumization, casualization and wellness trends.” The Los Angeles-based, digital-native brand is expected to contribute more than $100 million to Levi’s net revenue in FY22 and help Levi’s increase sales to women and build up its digital business. Levi’s is expected to expand Beyond Yoga’s wholesale distribution.

Sweaty Betty and Beyond Yoga face a host of competitors, from Lululemon, Gap-owned Athleta, Nike and to other similar niche up-starts.

On Wolverine’s investor call, Blake Krueger, CEO, said Sweaty Betty differentiates itself from market leader, Lululemon, by addressing ski, swim and biking activities rather than focusing largely on yoga and running. It also emphasizes color and lifestyle offerings. “We think it nails the way trends are moving with everyone going back to work but still wanting to stay very comfortable,” Mr. Krueger said.

- Wolverine Worldwide Acquires Women’s Activewear Brand Sweaty Betty – Wolverine Worldwide

- Wolverine Worldwide call to discuss the acquisition of Women’s Activewear Brand Sweaty Betty – Wolverine Worldwide

- Levi Strauss & Co. To Acquire Activewear Brand Beyond Yoga – Levi Strauss

- Wolverine Buys Sweaty Betty for $410 Million – The Wall Street Journal

- Wolverine World Wide Acquires Sweaty Betty – WWD

- Levi Strauss & Co. to Buy Beyond Yoga – Business Of Fashion

Discussion Questions

DISCUSSION QUESTIONS: Do the acquisitions of Sweaty Betty by Wolverine Worldwide and Beyond Yoga by Levi Strauss make strategic sense? Will both brands need to fine-tune their positioning in an increasingly crowded activewear space?

There’s no doubt the market for athleisure is big and that the pandemic has boosted growth. So there is room for many players to comfortably coexist. However the crowding into the market – by both national brands and retailers developing own-labels – means there are now more mouths to feed. That’s not an issue for the moment, but further down the line as competition increases and organic growth fades, I can see a crunch. Especially so for the weaker brands. It’s one of the reasons smart retailers, like Lululemon, are looking to create a whole ecosystem around wellness so that they have other revenue lines and points of differentiation that go beyond product.

The Sweaty Betty and Beyond Yoga acquisitions make perfect sense and are a great growth strategy for Levi’s and Wolverine in addition to helping these brands expand into new markets.

This is also a big win for Levi’s as they will not only acquire the comfort category’s knowledge, assets, and skillsets which they don’t currently possess as a denim brand but also a new customer segment that will continue to experience a huge lift post-pandemic.

This category is not going away and athleisure is here to stay.

Folding athleisure into the mix for Levi’s and Sweaty Betty is a solid strategy because their merged brands are in harmony and create a compatible ecosystem of products with a consistent quality level. But other companies who simply tack on athleisure in an attempt to capitalize on a trend won’t fare so well. Consumers are getting smarter by the minute and demand mergers and partnerships they perceive as legitimate rather than opportunistic. As more and more athletisure brands emerge we’re going to see this strategy polarize with Lululemon, Sweaty Betty and Athletica emerging as winners.

Every retailer in the business of selling casual clothes needs to compete in the active/fitness/athleisure space. It’s true for Gap as it grows its Athleta business, and also true for stores like Kohl’s that devote more floor space to the category.

If Levi’s or Wolverine want to play in this space, the fastest route is through acquisition of an existing brand even if those labels don’t have the recognition of Lululemon today. It certainly gives Levi’s in particular a way to diversify beyond denim and Dockers, and gives the company a brand to sell to its biggest retail accounts too.

Lululemon is known for high quality. People pay for high quality. Some say that Lululemon has a monopoly in the high quality activewear space. I don’t think so. There are plenty of others, big and small, that compete for this. Athleta is becoming a formidable competitor and while a duopoly is better than a monopoly, there is always room for more competition. And good for Levi’s for spotting an opportunity. Some might say they are late to the game, but there’s still plenty of time and room in this sector.

Yes, they’re a bit late to the game but the category is no longer limited to yoga-driven functionality or style. Given the growing number of athleisure-acceptable situations in our post-pandemic lives, these acquisitions make sense. In fact, Lululemon is popular to the point of being ubiquitous. This opens up the door to other premium plays, even if only in design/styling. After all, I’ve been in classes where everybody shows up in the same gear.

As the athleisure segment continues to grow there is room for established brands in adjacent segments to enter this space. For Levi’s, their CEO has recognized in previous statements, that denim will not likely make up more than 10% of the average consumer’s wardrobe, so growth must come from other areas. What better adjacent segment than athleisure for them? Given Levi’s record on direct to consumer to date, this acquisition makes sense and should work well for them.

For Wolverine, it’s also an adjacent space and their existing brands are a nice compliment to Sweaty Betty, so I expect similar success to Levi’s. Lululemon may be the premium brand to beat right now, but the market can sustain multiple brands for now as consumers expand their loyalty.

This is smart (even if late) portfolio balancing and evolution for both Levi’s and Wolverine. In a couple years we will look at pictures of what we used to think of as normal sportswear and it will look like horse and carriage era product. Athleisure and activewear is the future. The space is not yet crowded. It is ripe with opportunities.

Everyone I know prefers atheleisure and activewear to jeans….