Source: browse.com

Can a factory-to-consumer experience be a quality one?

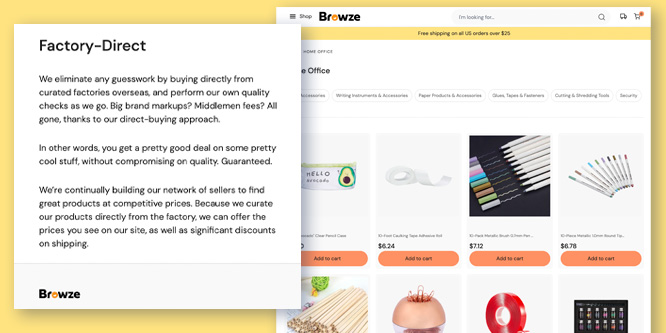

The CEO of curated the cross-border, online marketplace Browze sees factory-to-consumer shipping as a way to circumvent pandemic-era supply chain problems, and has a sourcing model in place that he claims gets rid of the quality concerns often associated with this method of fulfillment.

In an interview with Forbes, Browze CEO Izzy Rosenzweig said that the Browze marketplace has both minimized consumer wait times and kept business costs low through the use of airmail. While sea freight shipping costs have skyrocketed, airmail costs have remained consistent for months.

At the same time, Browze purports to address the problems often associated with overseas factory-direct marketplaces. Products sold on the website go through quality control testing, there is a no-frills refund policy and customers can return products domestically to Browze’s warehouse rather than having to deal with an overseas return.

Browze has taken other steps to improve its customer experience (and customer service score) as well. It recently implemented live 24/7 customer support chat and an improved self-service customer experience platform, according to a press release.

In June, Browze received an additional $5 million of Series A funding. The company is also receiving investor and advisor support from a former vice president of Chinese factory-direct marketplace Aliexpress.

Browze is not the only newer company that sees promise in cutting down on supply chain costs using a factory-to-consumer model.

Quinze, an eco-friendly factory-direct apparel company, sees not having to hold inventory as a path to creating more affordable clothing using higher-end organic materials, according to Forbes.

While these marketplaces aim to overcome the shipping and quality control problems that have long dogged this type of online retail, the most popular marketplace leveraging this model in the U.S., Wish, continues to face these challenges.

Wish customers still complain of long wait times and receiving counterfeit or low-quality knockoff products, according to The Motley Fool.

Wish does not appear to have smoothed over concerns about the viability of its business model with investors, either. Wish IPO’ed in December of 2020 with a share price of $23.55, and is currently trading around $3.

- The Future Of Retail Is Factory-To-Consumer – Forbes

- Browze Raises $12.5M Series A Funding to Revolutionize Cross Border E-Commerce – Browze

- Browze Garners Second Customer Service Accolade in Two Months – Globe Newswire

- New Online Fashion Brand Aims To Get Eco-Friendly Clothes From Factory-To-Closet At Affordable Prices – Forbes

- 5 Red Flags for Wish’s Future – The Motley Fool

- ContextLogic Inc. (WISH) – Yahoo! Finance

Discussion Questions

DISCUSSION QUESTIONS: Do you see Browze realistically being able to meet the quality control challenges and other problems cross-border factory-to-consumer marketplaces like Wish and Aliexpress allegedly face? Will we see the factory-to-consumer model expand beyond niche/novelty/buyer beware products and into a mainstream business model?

Disintermediation is a fact of life and has already begun. I see this model as the next thing beyond Amazon, the king or queen of disintermediation. Cutting out the middlemen is only a reality though if the customer can wait for the product. Retail’s survival is based on quick access to the product via real-time inventory and superior logistics. Factory to consumer will improve over time and be a force to reckon with — Nike is already leveraging this model.

Conceptually, cross-border factory-to-consumer marketplaces have some legs, however, they currently can’t compete with U.S. marketplaces like Amazon and Walmart. The lead times are one of the biggest issues. Consumers expect to receive product within two days and in many cases same-day. It looks like the current lead time for most products on Browze is three weeks. I have ordered from Wish in the past and the product arrived about two months after I ordered it. While I was happy with the quality of the product and the price, several months later, my credit card was hacked from the Wish website and I had to cancel my credit card. The credibility of these second- or third-tier marketplaces have an uphill battle to compete with the giant marketplaces.

These are exactly the types of solutions we need to start working around the supply chain crisis. That said, we still have to make sure manufacturers are taken care of during pandemic times. I think if the right checking agencies are in place, quality control shouldn’t be an issue. Some retailers have already gotten close to these models by limiting their involvement in the distribution network anyway, so this isn’t a tough business model to imagine becoming mainstream.

The factory-to-consumer model is an intriguing one. How many warehouses and stores between the factory and customer can be eliminated? How many different transportation costs? How many different shipping/handling/picking/packing/selling/delivery costs can be eliminated? How much of all this new efficiency can be passed along to the consumer in the form of reduced selling price? And how much is available to the factory and the new middleman in the form of profit? Seems like the biggest challenge is a combination of trust and timing. The Wish share price experience is a good illustration of the “looks good on paper” beginning and the hard realities of executing a whole new model. This might be one of those scenarios where it pays to be a fast second rather than being the pioneer.

Factory-to-consumer will gain traction as sustainability, personal carbon footprint, and product longevity become more important values to consumers.

Making returns easier for the consumer with a domestic DC will also help ease some hesitation around overseas shipping costs.

The biggest challenge will be on managing the speed of delivery. We want our purchases faster than ever and time is money. Educating the customer on quality products being worth the wait is still a giant hurdle retailers need to overcome. The luxury sector has this strategy down to a science with the lure of exclusivity, limited quantities, and seasonless product assortments.

As I read through this article I can’t stop thinking that the manufacturer is becoming a retailer. When manufacturers bypass all steps and go directly to consumers, they must understand the customer service and CX they now need to provide. Nike is doing an effective job of going direct to consumer. They have achieved a retail experience that is on par with the best retailers. The Browze plan has some baked-in benefits around logistics, but the rubber meets the road when it comes to the overall customer experience. That’s where they must also compete.

Matthew brings up some great questions with this topic. In this case, Browze is still a middleman. The factory-direct model incorporates concepts from the Just-In-Time era as well as a marketplace application wrapped in a different bow. However at its heart it’s just a better sourcing and buying department for the firm. For consumers, the concept of dependability will be a key differentiator and, over time, these smaller marketplaces can build attractive, reliable online shopping opportunities. But without the addition of physical placement, these opportunities will be challenged by the store-based and larger marketplaces. The cost issues may seem to have some value, but once the shipping traffic jam clears up, the airmail price advantages proffered will also vanish. These larger marketplaces have led with enormous crowdsourced reviews and rapid (high cost) delivery models, the smaller ones will need that same scale to become mainstream. Without some added value, it’s an unlikely bet.

Given the long wait times for some categories of goods, many consumers will start taking advantage of these new options, especially if prices and return policies are attractive.

No. There are too many manufacturing quality control issues, proper regulatory packaging and branding issues (like Prop. 65), and even simple packaging and communication issues (using easy to understand proper English) that have to be understood and overcome. Having done this for many companies for over 30 years, it is a huge hurdle that requires extensive experience and training to provide expertise in any marketplace, let alone multiple ones.

Is it just me or is “factory-to-consumer” marketplace an oxymoron? Isn’t the premise that there’s no intermediary … at all?

As for the basic question, I think the direct model will see a lot of growth — simply because, in an increasingly connected world, it’s inevitable — but it(they) will continue to be a small share of commerce; retailers (and wholesalers) really do serve a function.