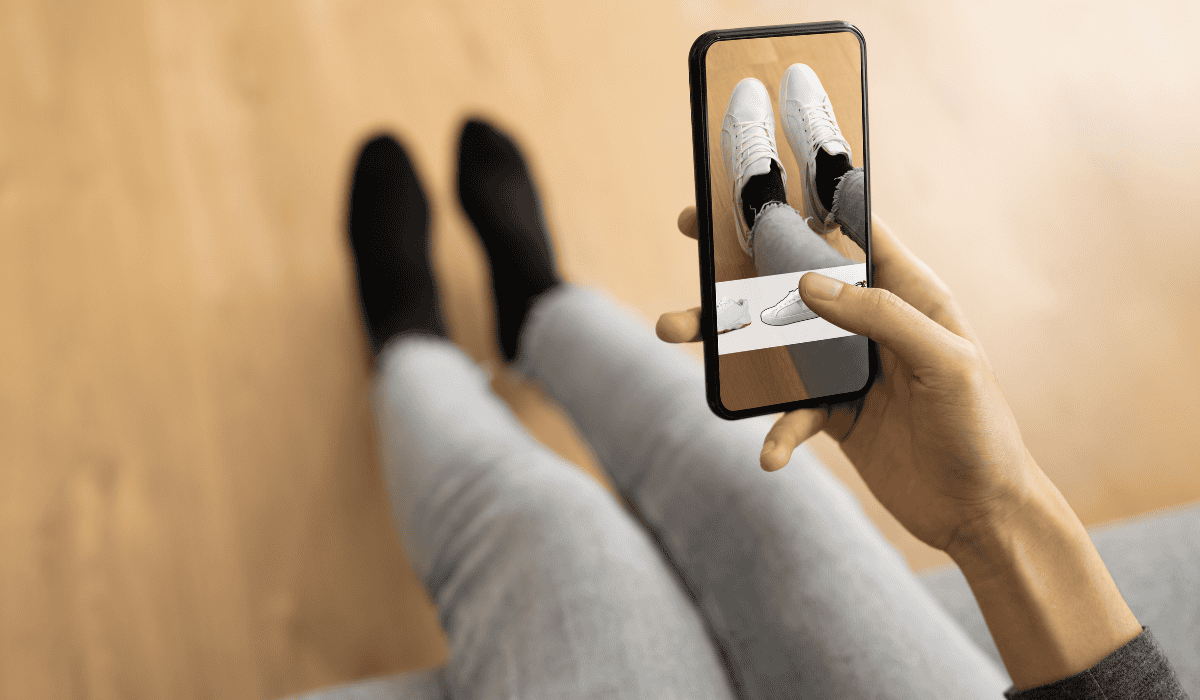

How Will AR/VR Transform the Retail Experience?

Will a data scientist shortage hurt Big Data’s promise?

Data Driven Marketing: You Must Market Your Change … to Change Marketing

How Do You Measure Customer Satisfaction?

Want to Raise Prices? Customer Segmentation Provides an Answer

Braintrust Query: Why Does So Much Customer Segmentation Analysis Lead to So Few Results?

BrainTrust Query: How Can Retailers Avoid Drowning in Big Data?

BrainBrainTrust Query: Grow Your Marketing Credibility Before It’s Too Late

BrainTrust Query: Beating the Fallacy of ‘Cheap’ Marketing