Source: Takeoff Technologies

Is robotic micro-fulfillment the path to streamlined grocery pickup?

Much of the news in the past year about robotic order packing has centered on the automation of big-scale warehouse operations. But a few startups have been working on robotic grocery fulfillment solutions on a smaller scale and their concepts are beginning to come to fruition.

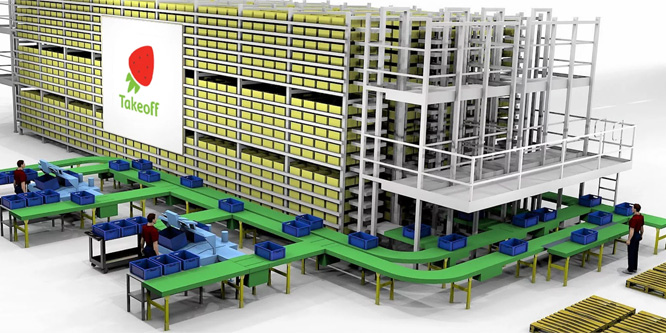

A startup called Takeoff Technology plans to launch a micro-fulfillment center in October which will use robots to handle order packing inside a grocery store, according to Fast Company. The technology is purported to facilitate the drive-thru pickup of a fully-prepared order within a half hour. The startup has not named the retail partner.

The micro-fulfillment centers within the stores Takeoff partners with are planned to be 6,000 to 10,000 square feet, an eighth of the size of a full grocery store, according to The Spoon. The company plans to use data collected from its retail partners to fine-tune its fulfillment procedures.

Israeli startup CommonSense Robotics has a similar solution that it foresees as being embedded in cities in a different manner, according to Supermarket News. The company’s 10,000 square-foot robotic fulfillment centers — which also make use of robots to bring packed groceries to human employees to prepare for pickup — are meant to take up otherwise underutilized spaces and basements and could be used to support multiple grocery stores at once. The startup already has a fulfillment center operating in Israel, with four additional centers planned for the coming year, including locations in the U.S. and the U.K.

These two solutions are somewhat different than previously-seen turnkey robotic solutions, like the one developed by Ocado. Ocado’s warehouses have been described as massive football field-sized robot hives, far larger than the micro-fulfillment centers, and designed to serve larger grocers. Ocado recently inked a deal with Kroger to develop automated warehouses for the chain.

Robots are also being put into practice to streamline click-and-collect processes and reduce wait times in other sectors of retail. Fast fashion retailer Zara, for example, is using robots to search store backrooms for orders and deposit them in drop boxes for collection.

- What if your grocery orders were prepared in a tiny robot warehouse? – Fast Company

- Takeoff is Creating New Hybrid Hyperlocal Robotic Grocery Fulfillment Centers – The Spoon

- Could robots and AI make delivery affordable for stores? – Supermarket News

- Will Ocado’s robots help U.S. grocers solve their online delivery problems? – RetailWire

- Ocado to automate Kroger warehouses in exclusive U.S. deal – RetailWire

- Robots become the moving force behind Zara’s click-and-collect ops – RetailWire

Discussion Questions

DISCUSSION QUESTIONS: Do you see robotic micro-fulfillment centers popping up in U.S. grocery stores in the next several years? Which elements of these solutions sound most promising and which are most challenging?

As the industry trend continues to move in the direction of drive-thru pick-up, and as wages rise, robotic micro-fulfillment will find its place in individual grocery stores, provided that the cost becomes sufficiently low to replace the manual labor, while hopefully getting the goods out faster. However, this will remain in the experimental stage for a couple of years or more before the larger chains adopt and install, and three to five years before the second-tier chains do. We are talking about having the extra space for the micro-fulfillment operation, or having to reduce selling space. If the concept takes hold then, as locations are remodeled and new ones are built, accommodations will be made to include the micro-fulfillment operation. An interesting evolution.

I find it interesting that Takeoff’s primary funder, at about $12 million, is a family-office, not a traditional VC firm. Its roots are in Latin America, and its managing director talks about the focus of its funds on that market. I wonder if that means we will see its first retail partners in Latin America, or perhaps in dense Hispanic neighborhoods in the U.S. More on the firm.

Anything that can reduce shrink and labor expense (the highest controllable expense beyond the COGS) via automation is worth serious consideration.

Most retailers are at least interested in third-party solutions that plug into their current footprints and allow them to cut costs. (Side-eye the retailer who isn’t at least interested in cutting costs, is all I’m saying.) Robots fulfilling orders in a tiny warehouse? Grocers I know of would probably jump at the chance to adopt Amazonian strategies and compete locally where the online behemoths can’t. Like all shiny tech, it’ll come down to deployment: Quick rollout, staff training and transitioning fulfillment jobs to new roles, meeting new customer expectations, having store-level robotics maintenance staff available for troubleshooting. To me, if the tech works, these fulfillment centers’ success will depend way more on the internal health of the retailer than anything else.

I actually know the company and its principals well. This is an amazing company and their ideas are not pie-in-the-sky. They have been successful in other areas of logistical fulfillment.

I believe this idea is the future of grocery retailing. It provides the time saving and convenience that is the unstoppable trend of shoppers today and more so tomorrow. As technology continues to develop tools to make shopping easier, consumers will adapt quickly and yesterday’s way will look like more and more of a burden.

Wholesome food on the table. Short of this, many will likely be disappointed with the quality of “fresh foods.” Fresh foods stacked in towers in dense warehouses seen only by robots will make quality control an issue.

Although freshness in food quality is subjective, just as eating at Chipotle is different than McDonald’s, price plays a part. In grocery, the price is a sliding scale for what the market will bear. Safeway, Kroger and the rest now charge a premium for the same exact product grocers like WinCo sell for 10 percent to 30 percent less. Then there are many who hate to grocery shop and have little interest in food. This trade-off is not a trade-off at all.

The concept is interesting, but tiny margins of 1.62 percent on average across regional grocers in the U.S. will make robotic micro-fulfillment challenging. The solution will not be standalone as suggested in the video, but as an add-on to physical supermarkets. Perimeter products will still be excluded. Demand prediction will become vital to the solution to maintain profitability. Converting customer buying habits will be an interesting journey. I doubt there would be significant adoption by small grocers — except as a trial or innovation until there is a real customer buying habit change. Large supermarkets will be looking for cost conversion across the entire supply chain, not just within a single market, hence the Ocado solution becomes more appealing. The promising outlook is as an add-on service for existing supermarket chains that are unable or unwilling to build their own click and collect services. The automation will compete against the Instacarts and delivery services of the world.

This is a solution looking for a problem. Workers still have ample time, are paid low enough and grocery stores are too complex to make this a reality. With the continued rise of customer focused stores, and the small amount of siphoning to drive-thru shoppers, this solution is not a near-term reality. Grocery stores still depend on appealing to human customers who walk their aisles, enjoying the smells and colors of the food offerings, while operating on razor-thin margins.

There’s definitely the opportunity for retailers to continue to build out the in-store experience. And there’s also room for a more efficient solution that potentially covers only a subset of staple items. If there’s a surplus of labor hours, I’d much rather see retailers putting that into customer service and experience training. When people engage the human factor it ends up serving everyone.

The short answer is no. Longer term will depend on enough customers changing their grocery buying habits to BOPIS. As has been noted before on RetailWire this would require customers being comfortable to someone else selecting the perishables.

Could see a hybrid solution where these systems pick non-perishables and then a customer adds their perishable selection to the complete the order. Would save the customer time in the store and reduce store labor restocking.