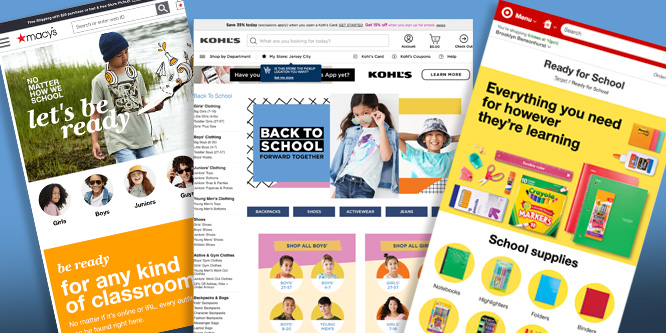

Sources: Macy’s, Kohl’s, Target

Retailers expected to ace the back-to-school sales test

Back-to-school spending hit a record high last year as parents spent more on items such as laptops and desks for the millions of kids across America forced to attend school virtually due to the spread of the novel coronavirus pandemic. This year, according to a new study, they will spend even more as their kids go back to classrooms, hopefully, full time.

U.S. retail sales are expected to grow 5.5 percent over last year during the July 15 through September 6 back-to-school period, according to Mastercard SpendingPulse. Sales are expected to post a 6.7 percent gain over 2019’s numbers.

“Back to school has always been a prime season for retailers. This year, the broader reopening brings an exciting wave of optimism as children prepare for another school year, and the grown-ups in their lives approach a similar ‘return to office’ scenario,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks. “This back-to-school season will be defined by choice as online sales remain robust, brick and mortar browsing regains momentum and strong promotions help retailers compete for shoppers’ wallets.”

Mastercard sees the growth during the back-to-school season as a continuation of a resurgence in retail over the past eight months. Online will remain a critical component of retailers’ selling toolboxes during the season, even as digital numbers fall 6.6 percent over last year, which still represents a 53.2 percent increase over 2019.

The move towards greater use of technology that gained a hold during the early days of the pandemic will continue this year with spending expected to jump another 13 percent.

What kids wear to go back to their classrooms full-time will also change from 2020. Apparel sales are expected to rocket up 78.2 percent year-over-year and 11.3 percent over 2019, which offers a better point of comparison.

Kids’ clothing needs are expected to benefit department stores. Mastercard is looking for sales in the vertical to improve 25.3 percent over last year and 9.5 percent over 2019. The research emphasizes that, while foot traffic will increase, it remains important for retailers to continue offering buy online and store pickup options as well as other low- or no-contact experiences.

- Back-to-School U.S. Retail Sales Expected to Grow 5.5%* Compared to Last Year, According to Mastercard SpendingPulse – Mastercard

- Coronavirus could push back-to-school spending to record level as uncertain families gear up for at-home learning – National Retail Federation

- Parents to spend even more on computers and desks as expectations of online classes increase – National Retail Federation

- What will retail’s back-to-school season look like this year? – RetailWire

Discussion Questions

DISCUSSION QUESTIONS: How do you see the 2021 back-to-school season shaping up for retailers? Should retailers go back to their 2019 playbooks for the new year, translate lessons learned in 2020 or come up with a completely new approach for back-to-school?

Wach for apparel categories for adults and kids to jump in the coming weeks. Parents that can afford it will overindulge kids that will be back to school for the first time in a while, and as the kids get back in school, parents will be able to go back to the office. And their wardrobes will need a refresh as well, after a year in athleisurewear.

Pent-up demand will likely push Back to School 2021 over the top in terms of sales. That being said, it’s likely we all have a closet full of hand sanitizer and wipes so we won’t be buying those this season.

Back-to-school will provide a very real window into the current performance of some of the recently weaker players versus those retailers that have been well managed over the last several years. It’s not tough to predict good things for Target and Best Buy. But the retailers that really need to bounce back from weaker performances, both before and during the pandemic, really need to demonstrate that they have learned a couple solid lessons and solid implementations in place. Gap, Macy’s and J.C. Penney come to mind.

The stock market seems to be reflecting a kind of euphoria around recent valuations assigned to some retailers. BTS is enough of a surge and deep enough into our recovery to give us a good barometer on the real health of the industry. Inflation and supply chain issues may complicate that read, but hey, it’s never easy.

As the enthusiasm for a return to “normal” increases and pent-up demand rules spending, the back-to-school season will benefit. Many students will be back in classrooms again and will be outfitted and supplied to the hilt by parents who are thrilled that they are finally back in school.

There will be a lot of demand for back-to-school products ranging from traditional store supplies to clothing. This year back-to-school season will have the unusual element of parents buying back to work clothes as well as clothing for their children. Business casual may be more of the norm in the office today but what they wore for Zooming may not be appropriate for the office.

I know why BTS purchases will be aggressive and exactly what the retailers want. My niece called last night and told me that all the clothes the three kids had in the house, purchased sometime last year, are now way too small or not “in,” as far as the children were concerned. (Make a note, that’s important.) I know it’s only one customer with three kids, but her purchases will be large, and I think she represents what we will see in stores. My guess is that every store in every city, and a flood of internet sites, will witness great sales volumes if they are are prepared! Happy days are here again — kinda.

Back-to-school season will put additional pressure on the already stressed supply chain – since most apparel is manufactured outside the country. It will be interesting to see how the second-hand market scales up to fill the demand gap.

I expect a very robust back-to-school season as things return to “normal.” The real trick to successful BTS and back-to-college, which is also a big deal, is understanding when to peak inventories by location based on school/college openings. Peaking too early eats up a lot of valuable floor space that might be better used for other product. Peak even a week to late and you risk missed sales. If I were still planning back-to-school I would certainly look at 2019 and older sales trends to try to forecast item velocity. I’d want to understand local school openings to understand the right weeks. I suspect at least some of the dates will change this year, so a quick poll of local store teams to understand these dates will be important.

Will definitely echo my colleagues on this thread. Bounce back in apparel, office supplies and electronics. We’ll see sporting goods doing well too. What might be a little different is the nature of clothing and returns. Lots of stockpiling went on, followed by dumping clothes to discounters and liquidators. So the market cycle begins again, but apparel will be buying less as discounters are paying less and either the retailer has stowed away last years apparel or has sold it off at high discounts, so there’s excess clothing inventory in the market. The demand has shifted as well towards WFH apparel so formal wear will be far less a focus. That said, everyone’s anticipating the bounce back and it becomes self-fulfilling at that point for retailers. Watch the TJ Maxx’s of the world doing especially well as they’ve sourced at fire sale prices.