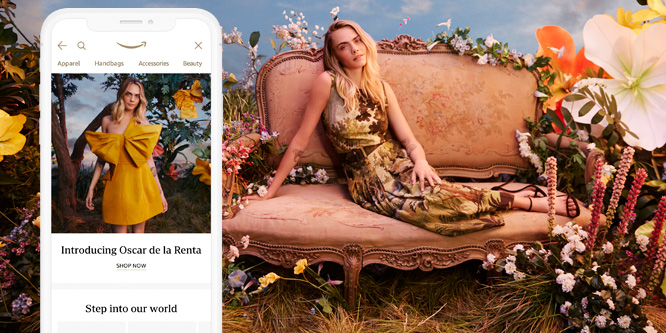

Photos: Amazon/Oscar de la Renta

Will Amazon’s new online store disrupt the luxury fashion and beauty business?

Amazon.com has launched an online store-within-a-store concept — Luxury Stores — with the goal of establishing itself as a major player in the luxury fashion, beauty and accessories market.

The e-tailing giant is looking to attract both established and startup brands to serve as the luxury everything store for its Prime members. Amazon’s timing, depending on its ability to attract popular brands, could be particularly troubling for upscale department and specialty stores already struggling in the face of challenges created by the coronavirus pandemic.

The first major brand working with Amazon is Oscar de la Renta. The designer will feature its Pre-Fall and Fall/Winter 2020 collections, including ready-to-wear apparel, handbags, jewelry, accessories and a new perfume. Childrenswear is expected to be added soon. The Fall/Winter collection is currently only available in de la Renta’s boutiques and on its website.

“I would guess that somewhere near 100 percent of our existing customers are on Amazon and a huge percentage of those are Prime members,” Oscar de la Renta CEO Alex Bolen told Vogue. “So, they’re already in that environment. For me to get more mindshare with existing customers in addition to getting new customers — that’s the name of the game. We want to be able to talk to her wherever she’s comfortable shopping.”

Luxury Stores is now available by invitation-only to eligible Prime members in the U.S. Those not already included may request an invitation through Amazon. Shoppers can access the store through the latest generation Amazon mobile app.

With its new offering, Amazon is also taking on concerns about counterfeits on its site. The e-tailer said all products purchased through Luxury Stores are sold directly by the brands themselves and guaranteed to be authentic.

Amazon is also seeking to address oft-voiced concerns about the luxury shopping experience, or lack thereof, on its site with “View in 360,” an interactive feature that allows Prime members to see the items they are thinking of buying in “360-degree detail,” according to a statement provided to the press. The idea behind the feature is to give shoppers a better idea of an item’s fit while making it easier and more entertaining to shop.

The designer and Amazon collaborated on a launch video for Luxury Stores starring Cara Delevingne.

- Luxury Stores video and images

- The next destination for luxury – Amazon.com

- Amazon Launches Luxury Stores on Its Mobile App With Oscar de la Renta as First Brand Partner – Vogue

- Will Amazon’s new luxury online store be fashion’s savior — or archenemy? – NBC News

- Will Bloomingdale’s grab hold of the luxury products market? – RetailWire

- Neiman Marcus launches digital hub to bring the in-store experience online – RetailWire

- Can luxury retail attract a new generation of shoppers? – RetailWire

Discussion Questions

DISCUSSION QUESTIONS: Will Amazon’s Luxury Stores disrupt the luxury fashion and beauty business? How do you expect Amazon’s retail rivals and mall operators to respond?

This is an interesting development and I think it may be successful at the margins, particularly with younger shoppers. However Amazon isn’t renowned for great curation and I don’t think that the developments in this platform go far enough to create a compelling experience. The fact that the offer is by invitation only – which admittedly may change in the future – just adds friction and makes it less than compelling. Amazon has an opportunity here for sure. But will it redefine luxury shopping and have the impact it has had in other segments? I don’t think so! However that does rather miss the point: not everything Amazon does is about creating the next big thing. It likes to experiment test, try and learn — and that’s a good thing.

Curation is indeed a question mark; another one is about personalized customer experience – which is a key element of the value that luxury brands offer their customers. Amazon’s strength is in mass-marketing – they can most probably develop the ability to pamper these customers, but how sustainable is it to support two business models: a mass-market, “no frill” business model, and a highly personalized model? The next question is whether customers will trust that Amazon can execute high-end, luxury-type customer service.

This has been rumored for a while, and is a bit overdue actually. The move addresses key concerns for both brands and consumers. Physical luxury retailers should be concerned.

For brands, controlling the brand registry and exclusive experience has been a priority. They would like to mimic a physical mall experience. Access to traffic while controlling the experience within the store. With a standard marketplace, the brand owners compete with unauthorized sellers and worse, counterfeit sellers.

From a customer standpoint, guaranteed authentic merchandise is a big win.

I doubt that Amazon will disrupt the luxury category, but it will have an impact just as it does on most categories in which it chooses to compete. While we usually look to Walmart and/or Target to respond to Amazon in some way, this will not be the case for luxury as this category is definitely not a focus for these retailers. I don’t expect to see any specific competitive response.

This may be a great idea, but I don’t know about long-term success. Luxury isn’t just getting the item; it’s also getting pampered with unbelievable service. There’s only so much one can receive online when it comes to “wowing” the customer. Indeed even the wealthy don’t mind a bargain, but I don’t know that they’ll be quick to make all their expensive purchases through Amazon. For them saving money is fine, but if you take away the glamour and superior treatment they receive in the high-end stores, their shopping experience may not be what they want. Only time will tell. I do believe in the short-term, Amazon will be quite successful with the concept.

I will repeat what Paula said last week – what luxury business?

I understand that Amazon wants to be all things to all people, but I don’t know how opportune this is right now and I don’t know this will make a dent in the already flailing luxury department store business.

I love the idea. If Amazon can perfect recommendation engines, bring in video, and provide backup from human stylists, this could really take off for the 1 percent!

It could be huge. There have been technologies skirting around this area for some time that could have offered new channels and approaches to selling – AR, VR, online consultations, etc. These have not been widely adopted but it could well be that Amazon’s entrance into the marketplace creates a catalyst such that they become more widely used.

The timing on the launch could not have been better as the pandemic has accelerated all things e-commerce. A year earlier an online luxury store would have been slow to take off. However with the increase we’ve seen this year in online shopping, Amazon’s luxury store has a pretty good chance of taking off.

No, Amazon is not going to disrupt the fashion and luxury business — not yet. They are conducting a grand experiment. Lots of learning to come out of this experiment. Now who’s going to be the best student? That’s when the disruption starts.

I have no idea if luxury shoppers will suddenly decide to look to Amazon as a shopping destination. I will say that Amazon has become such a dumping ground for counterfeits and shoddy knock-offs that I rarely buy anything except FMCG items from Amazon, and even then most of my purchases are actually from Whole Foods. Their assortment may be wide and deep, but the quality of that assortment is neither wide nor deep, and I think they have a long way to go earn the trust of luxury shoppers. So for now, I don’t see this as a major threat to traditional retailers and brands. But let’s revisit in six months and see if they have moved the needle on shopper trust before we pass final judgment.

“I would guess that somewhere near 100 percent of our existing customers are on Amazon and a huge percentage of those are Prime members,” – This is the fundamental premise behind any brand agreeing to open a luxury store on Amazon. The real question however is, even if this is true, are those customers inclined to buy $5,590 dresses via Amazon’s mobile app, 360-degree product views notwithstanding? This remains to be seen as one would expect that shopper to want a true luxury, in-person experience with a sales associate helping them at every step versus waiting for a brown box with a smile logo on it arriving at their doorstep.

I’ve been on the mobile app and seen the store, and while it does provide a visually more appealing format than the normal Amazon browsing experience, not every product leverages the 360-degree views. They do provide other elements you would expect, such as “complete the look” with other items from Oscar de la Renta, but it’s not easy providing the same luxury shopping experience as a specialty retail store on a smartphone screen. Maybe if there were some AR capability to supplement this…

This also has the look and feel of Amazon creating a new marketplace (aka, a “mall”) for luxury brands which in the future could become a foundation for a new Amazon Luxury brick and mortar store. Perhaps at an SPG mall near you…

You have to wonder how those luxury items will be packaged. Will the items be nestled in the designer’s beautiful box before being dropped into an Amazon smiley faced box? Presentation is key!

100% agree! Even with that type of treatment, there’s just something missing when the same old Prime delivery van pulls up to your home and drops the box on your doorstep while taking a photo of the drop-off. That doesn’t feel too luxurious to me … at least not for my $5500 merchandise!

Remember what I said on your LinkedIn post? “Gimme a case of Windex and a Louis Vuitton to go.” 🙂

No. Until people use the search bar to for finding the latest Chanel handbag rather than double A batteries, this isn’t going to amount to much. To be honest, just launching with one brand makes it feel like an afterthought. The Chinese platforms have forced luxury brands to go to them because that is how that consumer shops, however the U.S. luxury shopper isn’t there yet and I’m not sure when they will be.

Good point about Chinese consumers. They have very different shopping behaviors and thinking. Miles ahead in digital retail.

Finally: designer duds at your door! As the middle market hollows out, Amazon focuses on delighting upscale consumers.

This luxury play adds more value to affluent Prime members, helping Amazon capture more of their abundant disposable income. Since these consumers likely already shop at Whole Foods, Amazon will undoubtedly apply meaningful insights to sell more to them. Due to COVID-19’s travel constraints and overall ennui, these shoppers may be ravenous to reallocate this year’s vacation budget to pampering themselves with luxury goods.

Competitively, Walmart can’t touch this premium audience, as it’s focused on value tier goods and low-cost leadership. In the global retail space, this move helps Amazon’s efforts to erode Alibaba’s and JD.com’s top-of-mind status in the booming Chinese market, where luxury sales will continue to grow – even in a pandemic.

Initially, Amazon and Oscar de la Renta seem to be strange bedfellows. The move comes across as a little desperate on the luxury retailer’s part.

However, that said, I do think that this is the perfect time to launch the site. Consumers are online, on Amazon, and a bit bored. They will discover it and look – if for no reason other than curiosity. The bigger question is – will they buy? I’m not sure how many black-tie events are happening in the next six to 12 months. We’ll see.

In a word, no. Unless some disruptive event comes along that causes people to look for fashion in completely unlikely places, I don’t see it. But you know, I never saw myself preferring Walmart.com to Amazon for sundries, either.

The most wonderful and appealing aspect of the luxury shopping journey has been the exclusivity of the service and in-store multisensory experiences. LVMH, Kering, and other luxury houses have avoided partnering with Amazon and opening up marketplaces in the e-commerce giant’s ecosystem, as their business operating model has been built on exclusivity.

While having a presence on Amazon seems to be the go-to move, it’s not going to disrupt the fashion and beauty business. Accessibility may just end up diluting the authentic and exclusive nature of the luxury retail world, which is built on transporting experience, and not augmented reality and AI.

Where I do see this resonating with Amazon Prime customers is in the aspirational luxury brands — those that are looking to extend their reach and acquire new customers with their more affordable offerings.

After having conversations with luxury retailers it seems that, across the board, they’re having difficulty bringing their brand experience online. Given Amazon’s maturity in data processing this could be a real game changer for the luxury market, especially as more people are shopping online now than ever before. However what Amazon fails to do and will have to perfect is bringing that brand legacy and heritage into the online experience. So while on the one side luxury retailers are behind when it comes to processing data, Amazon fails to foster that same exclusivity that luxury brands have had for years. In the end, it will be a race to see who performs best.

The problem with Amazon’s entry here is that it’s Amazon. The nature of luxury is scarcity and the unique status conferred to those purchasing or owning it. Sure there is a slight quality factor, but the quality can be matched easily. The branding is what makes it unique. Does it matter if I have an Emega watch or an Omega watch? Absolutely – especially for those who can afford it. Amazon’s broad access and appeal and name automatically pulls it back into the mainstream, diminishing the luxury value including scarcity of product and status value attributed to it. Why do the luxury brands care about counterfeits?

Amazon’s retail rivals will be smart enough to brush this off and luxury brands won’t be overly concerned with the entry. Last point on this – the market has shifted substantially to Asia for luxury growth – Amazon’s track record there also limits the threat.

It will be interesting to see how this plays out. A few years back a colleague of mine said, “People only go to Amazon when they know what they need, not when they want to browse.”

I remember strongly disagreeing because, at the time I was on a huge “Interesting Finds” kick on Amazon. (If you aren’t familiar— this was a section where Amazon highlighted unique finds from smaller retailers and influencers could curate recommendations.) Spoiler: I spent a lot of money by “browsing” that section. Now this is under the “Gift Finder” section of Amazon—which I do think is more of where folks browse — because who knows what to get their 10-year-old niece that has everything already?

All that is to say, this may take off with a specific subset of people who already shop luxury, but my guess is that it will remain obscure (like the Interesting Finds section) for the majority.

So much hype, so little content. Kicking off with Oscar de la Renta? Invitation only? Really? What “luxury” brands? This is a new concept? Amazon has been trying for at least a decade to sell “luxury.” This is a fine demonstration of Amazon spin at its best. “360-degree retail,” store-within-a-store, “easier and more entertaining to shop.” Rickety props extrapolated as brave new technologies. Showcasing “luxury” led by Amazon engineers as shopping guides. The headset of the luxury shopper is not the same as one-off sales on an eCommerce platform.

Do I think Amazon’s Luxury Stores will disrupt the luxury market? Nope.

A true luxury customer might occasionally visit Target, but she’s not going to buy a five-figure handbag on a website that also sells cat food. Every retailer has a place but luxury purchases belong in stores — and websites — with superior customer service — that’s half the charm.

This luxury site should work. There are millions of eyes on the Amazon site every day. Some of those eyeballs can be easily directed to the luxury section of Amazon. This will provide luxury brands exposure to a much larger set of consumers than their own stores and websites can provide. This will begin to disrupt the luxury fashion and beauty business especially if the Amazon prices are lower than the retail prices as I suspect will happen over time. Some of Amazon’s rivals will respond in kind if they have positioned themselves in the luxury space. They will not be able to let Amazon slip away with their customers.

Why would Amazon not buy Net-a-Porter?

No. The luxury market thrives on having their customer experience include come to them and surround them with products which they select. Buying a car means having it shown, test-driven, and delivered right to your door step. The same applies for service. The high-end jewelry market has done this for years. High-end clothing, especially custom clothing, is all done at the customer’s location. Offering this online is trying to make the online experience fit all customers, and now is not the time for this.

I think Amazon is testing how well its customers would buy first-run exclusive luxury items off the runway, like Moda Operandi does. Really, the question is whether the luxury brands would be willing to work with Amazon. Given COVID, you can’t really do luxury shopping experiences in person and be pampered, so it comes down to the trust of the luxury brand. Amazon is basically saying “you trust the luxury brand, we are the middleman to deliver an authentic item to you exclusively.” The customer gets the Oscar De La Renta, Amazon delivery will not be mentioned, so customer is happy, brand is happy, Amazon gets a piece of the business.

Is it mass disruption of luxury? I don’t think so. Is it a viable business and testing ground for Amazon? Yes.

Luxury in 2020 is dominated by a few major players. Will they go along with this distribution scheme or will they resist? Many of the luxury companies have been moving to move away from third party distribution. Perhaps if Amazon is patient and willing to play a long game, they will succeed. Will the Amazon site be a truly distinct luxury offering? Or will it be a place for tired luxury brands looking to increase distribution or make up for losing contracts or volume at department stores? Time will tell….

Lots of smart comments here on the Amazon-Lux initiative.

Amazon has a history of running large experiments; this is one of them. Important here is how they have learned from prior ones by now giving the brands control of the product, store, and maybe shopper data (don’t know on this one). For Amazon, this is an opportunity for them to more cleanly identify high-end, high-spend Prime members. That insight allows for them to better merchandise the recommendations for the basic Amazon store. It also allows them to identify the geographic clusters of ENGAGED high-end Prime members. That it turn allows for them to identify where they can locate high-end boutique stores for returns AND highly-informed curated styling sessions. Such sessions have significant conversion rates, basket lifts, and low return rates. (See article here).

Moreover, over time Amazon needs to expand into new large areas of consumption (PCE) such as travel to allow for a mash-up of travel+content+merchandise that will allow for a longer-period of hyper-growth beyond COVID’s digitization. (See here). Having identified these clusters also allows for more options in that TAM expansion.