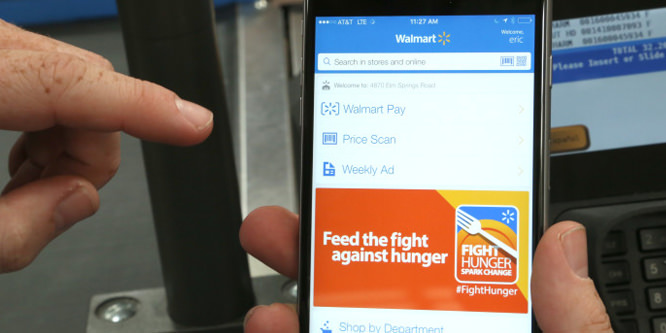

Photo: Walmart

Walmart in no hurry to add other mobile payment options

Walmart Pay, the retailer’s answer to Apple Pay and other mobile payment apps, is now available in all 4,600+ of its U.S. stores. Based on early results, it does not appear as though the chain is going to be offering its customers any competitive options in the near future.

According to an infographic published by the retailer:

- Three out of four customers have given Walmart Pay a five-star rating;

- Four out of five would recommend using it.

The chain reported a 45 percent increase in Walmart Pay transactions over the last week (it did not provide an absolute number). Walmart also said 88 percent of transactions are coming from repeat users.

“There is something very powerful about the ease and simplicity of Walmart Pay,” said Daniel Eckert, senior vice president, services, Walmart U.S. “What’s even more powerful, though, is what this means for our customers. We want to make every day easier for busy families. We’re connecting all the parts of Walmart into one seamless shopping experience with great stores, easy pickup, fast delivery, frictionless checkout and apps and websites that are simple to use.”

Walmart has emphasized the security of Walmart Pay, which is part of the company’s mobile app. Payment details are not stored on customers’ phones and none are exchanged at the checkout.

While the retailer is touting the benefits of Walmart Pay and its evolution as a customer-focused business, others are less impressed.

“Credit cards are incredibly easy to use; you simply dip or swipe,” David King, senior manager in the internal audit, risk and compliance practice at UHY Advisors, told Bankrate. “Apple Pay is almost as easy, but requires some practice. Walmart Pay is the least intuitive because you have to trigger an app and complete a scan through a barcode reader.”

An article on the Computerworld website followed the same logic, questioning why the retailer is emphasizing ease of use when other payment options are simpler to use than Walmart Pay. It also points out that Walmart Pay only works at Walmart.

Discussion Questions

DISCUSSION QUESTIONS: Do you expect Walmart Pay will be a winner for the retailer? If you were in charge of Walmart Pay’s development, what would its next generation look like? How do you see Walmart Pay fitting into the evolution of Walmart as a retailer?

Was the satisfaction survey taken amongst the 10 subscribers to Walmart Pay? I don’t see this being successful in the long run. Consumers have repeatedly shown that they want one payment system that can be easily used across multiple, if not all, retailers.

A store-specific “pay” system is as dead-end as the store-specific credit card. Not that it cannot generate significant activity pending wider deployment of things like Apple Pay, etc. The problem is that shoppers do NOT want to carry around cards (or tags) for all the stores where they shop. Having several cards for different personal/business purposes is a big enough hassle. Having different cards for different retailers makes no sense.

HOWEVER, until there is a Visa pay, widely adopted, an individual retailer like Walmart does have an opportunity to make it work for them — and ultimately use this in leveraging their relation to Amex, Visa or whoever takes over dominating global payments. Notice, for example, Costco’s shedding their Amex program in favor of Citibank. Maybe this will work, because you have to have a Costco card to get in the door anyway (membership). How this will work in the broader retail world is not yet clear.

It looks a little like an Amazon copy cat — sort of. Amazon customers in their new brick-and-mortar stores have to use their Amazon account to make purchases. While this may work for Amazon, we have to remember that Amazon started online. So the customer is accustomed to being signed into their Amazon account.

Also, and this is a big also, Amazon uses your information in order to curate and personalize for you. The app lets you look up reviews and pricing as well.

Perhaps if Walmart can take this approach a step or five further, their customer will not mind the extra steps. Remember retailers, you have to serve before you can sell.

For my 2 cents.

This may be a case where your existing customers all like your approach but your approach may — in the long term — alienate potential new customers. Walmart shoppers are loyal and trust the brand, so they probably see Walmart Pay as a good thing, but I’m not so sure that the majority of all customers like any system that limits their convenient payment.

Ever been to a Nordstrom when a customer is told they can’t charge their purchases on their Visa or MasterCard? It isn’t pretty.

I use Walmart Pay and find it quite easy and efficient. Just capture the QR and off I go without waiting for a receipt. It seems that any time Walmart develops a customer-centric digital/mobile innovation, the naysayers come out of the woodwork, often implying that “Walmart customers” will be slow to adopt. Walmart is smart to keep its customers in its ecosystem and the rest of the industry will benefit as Walmart once again accelerates usage of these types of solutions with millions of customers, customers who also shop in other places. Next steps will be for Walmart to fully integrate Walmart Pay with Walmart.com. As it puts the pedal to the metal on onboarding new sellers on its online marketplace, the scale will be massive.

How many loyal customers are using the Walmart pay system? Will potential customers be motivated to shop at a new store with its own payment system? Even Costco is allowing a variety of credit cards. A common system that works in all stores will be more attractive to customers.

I’m not a fan of retailer-specific mobile apps. I shop in lots of places and don’t want to manage multiple apps any more than I want to carry two dozen loyalty cards in a bulging wallet. So Walmart isn’t tempting me with its proprietary mobile payments system, despite some admirable security features. In fact, it kind of alienates me. I do think the receipt storage feature is worthy of emulation by others.

Mobile payments operate in uncharted territory. But if you give users features they want, eventually you will succeed. Walmart-backed CurrentC went nowhere, partly because of a focus on bypassing interchange fees rather than customer experience.

Now there’s Walmart Pay. Retailer-specific payment platforms are rare, but even in uncharted territory there are examples to follow. Walmart Pay is oriented around shopper needs, blending shopping lists, prescription refills, gift card storage and payments into one app. But Walmart would be wise learn from Starbucks, which added loyalty discount programs and order-ahead line shortening to encourage usage.

Walmart reported last year that just over 15 percent of its 140 million weekly customers used its app, but many fewer actually paid with the app. Compare that to Starbucks, which derives 24 percent of revenue from an app focused on customer experience.

In order to continue the marketing strategy of selling price there must be an aggressive effort to reduce costs of goods sold on all fronts. This is what companies like Walmart live with all day, every day. Just like the IRS, banks are getting their money before the owner. They are in virtual control of corporate cash flow and profit levels because of their ownership of ATM machines, credit card and debit card systems.

The retail business is very aware of the strangle hold and will continue to move to replace this with their own paper as allowable. Just as they have brought in groceries, pharmaceuticals, eye care, and other new business offerings, the move into banking is not just being discussed. As insurance, loans and investments are morphing into low return e-commerce, business banks are forced to pressure the public into paying more for product by charging retailers more for the transactions. I recall when these bank services were sold as a means to reduce accounting overhead and getting the revenue quicker. Now if costs are the reason, many small and medium businesses are in trouble. So if you can’t win with the bank, why not be the bank?