Source: Nike

Segmentation is central to Nike’s success

Nike has more than 100 million members in its Nike+ loyalty program and hopes to triple that number in the next five years, the company’s chief digital officer, Adam Sussman, explained in a keynote session at Shoptalk.

The company is keen to add to its ranks as Nike+ members shopping on the brand’s elevated platforms spend nearly four times the amount as non-member guests. This is a fact Mr. Sussman attributes to correctly targeting customers, which Nike defines by segment.

“Ultimately, we know when we deliver the exact right product, experience and storytelling it makes a tremendous difference,” he said.

Mr. Sussman described three of the customer segments that Nike has broken out and the different lifestyle-targeted offerings it makes available to them.

The “Weekend Runner” is a 30-year-old woman with a half marathon coming up in a few months, said Mr. Sussman. As an active user of the Nike Run Club app, the company has a great deal of data on her running and achievements. Nike recently added an app feature, which plays recorded encouragement and advice from coaches, and has another that recommends shoes based on a runner’s mileage and running habits.

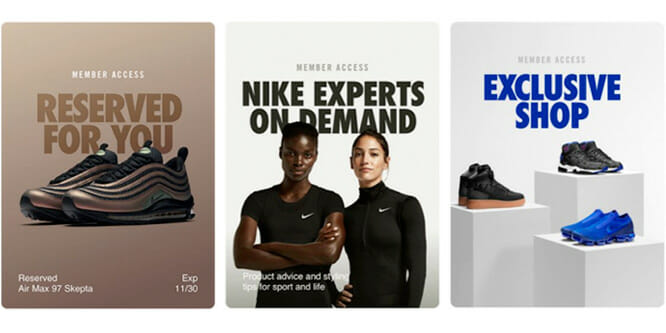

The “Style Shopper” is defined as a 26-year-old woman who wants to be on-trend before, during and after workouts. The Nike app is tailored to this customer, featuring information on athletes and what Nike products they wear. It also includes data-based product recommendations, invitations and a “Reserved For You” function, which automatically reserves select products for customers in the correct size and invites them to buy. The app also allows users to message directly with accomplished athletes for product recommendations or even book a face-to-face appointment.

For the “Dedicated Sneakerhead” segment, Nike has taken steps such as gamifying its exclusive product launches with its SNKR Stash experience. With SNKR Stash, Sneakerheads go on a city-wide treasure hunt for virtual “Stash Spots” where they can purchase the products via mobile. Nike plans to enhance the experience with Stash Squad, now in development, which allows fans in areas remote from a treasure hunt to join a “squad,” watch the event via livestream and receive the product if their squad leader wins.

Discussion Questions

DISCUSSION QUESTIONS: How important is it for brands to create customer segment profiles, like Nike’s “Weekend Runner,” “Style Shopper” and “Dedicated Sneakerhead,” when developing next-gen customer-facing technology? What sort of data should brands base segment profiles on, and how can they get it?

It’s essential, a message shared with everyone should be shared with no one. Consumers want a personalized experience, a feeling of connection and, most importantly, not to be another general statistic.

Group segmentation can be difficult for brands and marketing can easily get lost in the details if not done correctly. Having a handful of target groups requires more effort and resources but the dividends are much higher and can be what accelerates the success of one brand versus the other.

There are hundreds of demographics available and brands that have the most success find a unique niche and identify what makes their products so valuable to their market. Understanding this is the first step in creating successful customer segment profiles.

Segmentation is central to data-enabled marketing and each segment has its own points in community of interest interaction. Browse and purchase history, social media postings and data related to demographic, psychographic and geographic makeup all fuel development and deepening of segment profiles. Brands that do otherwise are living on hope and prayer alone.

Retailers already have the necessary data, via the transaction history, to drive proper customer segmentation profiles. In the case of Nike and other specialty retailers, it’s critical to get this segmentation right to offer the personalized and customized experience each customer group is seeking. Timely, customized and personal recommendations linked to your transaction and health data could ultimately make the difference between remaining loyal to Nike or other specialty athletic companies.

It has been proven that if retailers are able to offer a transporting experience, consumers are more than willing to opt for offers, personalized emails, etc., however, the days of sending out surveys are over, since companies have more than enough data to get the customer segments correct.

I think it depends on a lot of things. One, you have to make sure that your segments are big enough to be helpful in thinking about how to service them — distinct from other segments. But you also have to be careful that your segments are not so big that you are aggregating too much and hiding important distinctions. There’s also something to be said about the human capacity for remembering lists or groups — if you’ve got more than seven, then it’s going to be difficult for people in the organization to remember the segments in order to be able to use them in any meaningful way.

Segments also evolve. Especially when you have an age attached to the profile in the segment, you have to think about what happens when that profile “ages out” of the segment. What happens to that 30-year-old weekend runner when she hits 40? Retailers and brands should have at least some lifecycle thinking about milestones that consumers hit and how that impacts how they see themselves and which segment they really belong in.

Finally, there’s a big difference between actual segments and strategic segments. J.C. Penney in the Ron Johnson era is a classic example of how not understanding the importance of both — and balancing that importance — can be catastrophic. J.C. Penney had an actual segment of women shoppers that was older and less well-off than the strategic segment that Johnson wanted to target. That’s all well and good, but among the many things that went wrong during that attempted transformation, they lost way too many actual segment shoppers too fast, without having gained the trust of the new, strategic segment shoppers.

So — segments are good. They are a great way for companies to talk about consumers and develop a shared understanding of who these consumers are and what they seek from the brand. But they can go desperately wrong, too, if companies aren’t careful about how they use them.

Interesting discussion — but it raises more concerns for Nike than it helps put to rest. Two thoughts:

First, they confirm what direct marketers have known for decades — if you want to increase countable direct results (like this loyalty program) then segmentation and focus will do that. BUT obsession with countable direct response leads companies to ignore larger, more profitable opportunities.

Second, Nike’s just reported quarterly numbers were incredibly lukewarm with a number of concerning items. Primarily, they show limited revenue growth and increase in cost. That’s what you’d expect from the program he described. (It’s also what you’d expect from the uninteresting styles Nike has released in the past year.)

As one local to Nike campus, I’m concerned for Nike’s future. And a massive, retail-based company shouting about their hyper focus on segments doesn’t make me feel any more comfortable.

The concept of personalization is hot, especially when we can use AI to help us better understand our customers. Even with 100 million members in Nike’s loyalty program, it is surprising how few segments there are. Most companies have between three and five segments, also known as personas, that cover more than 90 percent of their customers, if not more. With Nike’s sophistication in managing data, they could and should have more personas, allowing to target market specific interests, usage of product, etc. This is powerful, as the very specific content is pushed to the different segments. And as the title reads, “Segmentation is central to Nike’s success,” it is actually central to any company’s success. The right information to the right customer a the right time can create loyalty and give a company a powerful edge over its competition.

It is a golden time to leverage data and manage technology to speak directly to your best customers with personalized/customized relevance. Building that foundation still starts with optimizing your capabilities to mine POS/purchase history data for the most actionable insights. One can then layer on click-stream data, social and real-time data and the go-to-market art-of-the-possible around integrated customer and merchandise data, etc.

“Ultimately, we know when we deliver the exact right product, experience and storytelling it makes a tremendous difference.” It is really table stakes now for a progressive brand like Nike to put a material strategic emphasis on loyalty and a scalable granular understanding of their top-tier customers by spend, by profitability, by behavior and lifestyle, etc. This is a great call-to-action for retail across the board and a notable example in Nike: Taking the words “off of the wall” and making it happen at scale.

If CPG brands AND retailers want to provide a truly real-time personalized shopping journey, the need to define segments, or “personas.” These personas can be determined via customer experience analytics tools available today, that capture both internal and external data sources like company call center data, shopper reviews, etc., and external sources, like local events, news, social chatter, etc.

The key is to cross-reference all this data so you don’t erroneously define a shopper as a specific persona when that shopper is actually someone quite different from that persona. This video shares an example, with apologies for the “IBM” logo at the end.

The more a brand knows about its customer the better. This is true for all brands. While the dream of true 1:1 personalization still exists, products and services usually need scale audiences (segments) to be successful. People do place a premium on their personal data (less so in the U.S. than Europe) so there must be some type of value exchange to make them share. Brands need to answer the question, “what’s in it for me?” from their customer’s perspective and deliver upon that to be successful.

I think brands have never known as much, or had the opportunity to know as much, about their customers as they do now. As such, there’s an opportunity to do segmentation in a meaningful way. I would be wary of putting people into fixed boxes though as individuals tend not to match up to specific criteria, and I think you also need to monitor those customers as they may change overtime, e.g. the Style Shopper could become a Dedicated Sneakerhead. This is a good step towards real personalisation though and making sure that all interactions serve the customer with useful, interesting and relevant information.

Brands — especially those with stores — intuitively know their shopper and what ends up as a persona usually ends up that way for a strategic reason. Each persona needs to be supported as if they were say … subscribers to a magazine. So now you’re a publisher, how often do you need to publish? What do you need to publish and how will each be actionable?

I suppose if you put together a paper prototype and tested the idea, it will help you uncover the unknowns, but brands are already into this in a deep deep way. So, taking a step back, since this question is being asked on RetailWire, I am going to guess that this is really directed at retailers who may be taking their first steps at this.

First, the good news is you have stores where you can learn the high level magazine titles and potential articles — the classic persona project — but in the end, it becomes a publishing project. And that brings us back to last week’s User Generated Content article here on RetailWire.

I think imagining yourself as the publisher of multiple magazines might be a good way to start. Of course $50-75k will buy you some nice 2X2 diagrams and infographics to help figure this out from a branding agency. Perhaps that’s the real question: what goes into an RFP to engage an agency and once you have their results, how do you execute? “Go for it” is a slogan, not a plan. Just thinking out loud.