Jet.com looks to disrupt online retailing

Through a special arrangement, presented here for discussion is an excerpt of a current article from Commerce Anywhere Blog.

It used to be that I always assumed Amazon had the lowest price. Now I have to double-check before placing an order. Lately, Amazon has been focused more on customer experience than price, offering lots of goodies for Prime customers and really fast shipping. Might that allow a new competitor to enter the market?

In the early days, Diapers.com sometimes had to buy diapers at Costco to ship to its subscription customers, sacrificing margin for share while the rest of infrastructure caught up. The company was based on supply chain efficiencies and a lower cost to acquire and retain customers. It worked so well that Amazon first fought them, then bought them.

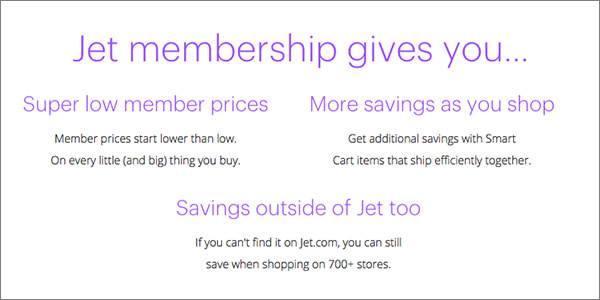

So after spending two years with Amazon, Marc Lore, co-founder of Diaper.com parent company Quidsi, is on his own again building a new kind of retailer. Jet.com is a cross between Costco and eBay with a huge focus on squeezing out every nickel of savings. Consumers pay a $50-a-year membership fee, which is the only income for Jet.com. Then Jet.com offers products from various retailers at deep discounts. Those discounts come from passing on sales commissions, using the most economical shipping, combining orders and avoiding credit cards.

Source: Jet.com website

In a recent note on a new funding round, Mr. Lore wrote that Jet.com doesn’t compete with its retail partners, "rather, we empower them with pricing tools that enable them to set different rules based on their business goals and profit targets."

"As a result," wrote Mr. Lore, "Jet is able to dynamically adjust prices in real time in response to the unique composition of a shopper’s basket, always maximizing for cost-savings."

To be successful, Jet.com must have the world’s most efficient supply chain — perhaps more efficient than Amazon and Walmart. The lynchpin will be an intelligent order management system that can efficiently source, combine and ship products at the lowest cost. There will also need to be lots of creative deals with merchants to lower prices in exchange for waiving the right to return merchandise, sharing customer data or establishing subscriptions.

Of course, this business plan requires massive scale, so the trick will be staying in business long enough to establish a large and loyal customer base. Jet.com has already raised $220 million before the website is even live, every penny of which is required for infrastructure and marketing. But I just don’t think Amazon and Walmart will stand by idly. I think a major online price war is on the horizon, and consumers will be the big beneficiaries.

Discussion Questions

What do you think of the Jet.com business model? What will it take to succeed?

At this point, Jet looks like more hype than reality. The assortment is smaller than advertised, the product taxonomy and content is still in progress and the pricing is TBD.

It’s an interesting extension of ideas that Amazon pioneered — namely, making economic tradeoffs more explicit to shoppers by letting them trade convenience or other factors for savings.

Definitely one to watch, but it will be an uphill battle. Amazon’s competitive moat derives from fulfillment and technology infrastructure, which are a lot harder to replicate (even with $220M in venture capital) than it would be for Amazon to add more flexibility for Prime members.

I remember when we were all dubious that anyone would go beyond buying books with Amazon. It seemed to be a stretch at best that people would be open to buying ANYthing from them. Now look.

One thing that seems to hold true is that when you give people something that they really, really want, it’s hard to not build a successful business on it. People really, really want to get the best price on the stuff that they buy, at least when they are buying it online, and at the expense of high-end service.

Keith is right, it’s going to come down to if they can really pay it off to make it worth the $50.

I’ll be interested to see what others have to say about Jet.com. Visit the site and you’ll see a box of Tide. It’s super hard to imagine that a company that requires a $50 membership fee and that delivers heavy, low-margin items like Tide can achieve the lift to outsmart a ruthless operator like Amazon.

As a consumer I am always a click away from checking out another source. If Jet.com is going to be competitive with Amazon, Walmart, etc., its financial foundation has to have the flexibility that goes with great revenue in some categories and not so much in others. And what about that “adjusting prices” comment?

When I needed a new wireless mouse, the possibility of saving a few dollars was not going to distract me from the fast shipping of Amazon. If I am in the market for a new tablet which costs several hundred dollars, I’m going to click until I find the right brand/value combination. Shipping isn’t part of the decision criteria because I’ll get that tablet quick enough.

The attractiveness of the $50 annual fee will depend on how consumers visualize the return. And that return will be based on availability of 1. Products, 2. Good values and 3. Great shipping/timing.

This is an uphill climb for Jet.com and the companies that want to be on board with them.

Jet’s Marc Lore seems to care deeply about his customers based on the interviews he has given and you don’t get that warm and fuzzy feeling from Bezos. Jet is taking on a huge challenge by disrupting the shopper’s mindset of instant gratification and the purchase and delivery model that Amazon has established. If they can get consumers to change their shopping behavior by providing great value, then Jet has a brilliant future ahead!

Somehow I am having a problem reading this and thinking Amazon is going to sit idly by watching and waiting for them to become a player in the market. This business model is going to require a huge scale in the subscriber base in order to be successful. Amazon is not going to let that happen. But what could happen is Amazon will take notice and possibly find a way to create a lower cost point. That would mean we are the winners.

To win at the dynamic pricing game, Jet needs to outdo its competitors at: (1) tracking competitive price information, (2) lowering delivery costs, (3) paring down transaction costs, (4) limiting inventory on-hand (cash requirements), (5) minimizing CapEx and (6) deeply understanding what motivates its shoppers.

All this assumes that Jet offers branded products that may be obtained from other retail outlets.

Can better, faster, cheaper implementation win the day? It’s happened before across the span of retail history, but the available differentials get narrower with each new iteration. If the Jet engine delivers the best total basket price with minimal shopper effort, it has a chance to be a game-changer.

The Jet.com business model is just another version of the online business coming to fruition. This is inspired by Amazon and will continue to be dominated by Amazon. Jet is another competitor, not a market leader. Getting the purchasing power of Amazon is going to take a lot of business and many more rounds of funding, before Jet.com can even think about offering the same pricing, let alone the same model….

Only time will tell. Perhaps the real question is whether this model will attract enough subscribers at $50 each to make it profitable, if its claim to only be making money off of subscribers and not from the products it sells holds true.