Instacart scores vendor ads

Moving further down the supply chain, Instacart Inc., the grocery delivery start-up, has partnered with a number of vendors to help defray delivery expenses.

General Mills, Unilever, Coca Cola, PepsiCo, Campbell, SC Johnson and other consumer goods companies are offering coupons and paying to advertise on Instacart’s website.

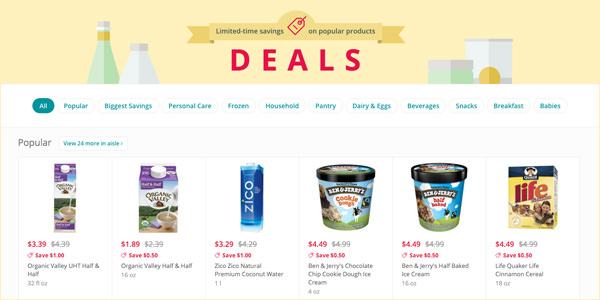

Customers navigate to Instacart Deals from the homepage or by visiting instacart.com/store/deals. When they click to add discounted products to their basket, the virtual coupons are immediately applied and the savings are seen at checkout. Examples of ads seen include free delivery for spending $10 on Red Bull or 75 cents off Dove soap.

In its sixth month, the vendor program now makes up 15 percent of Instacart’s revenue, according to Bloomberg News. Apoorva Mehta, Instacart’s CEO, told Bloomberg, “It’s like AdWords for groceries.”

According to Instacart, consumers benefit from the ease of one-click deals and avoiding “the days of coupon cutting and wandering stores to find the exact promotion.” Brands only pay for redemptions, as opposed to the typical setup of paying for distribution and estimating potential redemption rates.

“This new platform revolutionizes the coupon space by allowing shoppers to browse for deals and offers on Unilever brands such as Dove, Lipton, and Ben & Jerry’s items every day across Instacart’s broad retailer network, and see the savings immediately at checkout,” said Doug Straton, VP, digital-e-commerce for Unilever, when the program was officially announced last November. “Importantly, it should prove to be extremely efficient in targeting the right shoppers for those offers.”

The apparent early success of Instacart Deals comes amid recent reports that Instacart is cutting its hourly pay for some delivery workers in another bid to shore up profitability. In December, it raised delivery fees for customers to $5.99 from $3.99. Instacart also makes money by charging more than retail prices for items at some stores or through commissions paid by the grocer.

- Instacart Launches “Instacart Deals” – Instacart

- Instacart Gets Red Bull and Doritos to Pay Your Delivery Fees – Bloomberg

- Instacart, a Startup Worth $2 Billion, Slashes Pay of Some of Its Lowest-Paid Workers – re/code

- Inside Instacart’s fraught and misguided quest to become the Uber of groceries – Quartz

- Grocery-Delivery Startup Instacart Cuts Pay for Couriers – The Wall Street Journal (sub required)

Source: instacart.com/store/deals

Discussion Questions

DISCUSSION QUESTIONS: Will vendors increasingly get involved in helping subsidize grocery delivery costs through advertising and couponing? Do you see consumers, brands or retailers gaining the most benefit from a platform such as Instacart Deals?

This sounds great for shoppers and brands. Over time, brands will likely want more data on the performance of their products on Instacart’s platform, which represents another possible revenue stream.

There’s less clarity on how it impacts retailers. Are these ads funded by trade or brand budgets? Is there any revenue share with the retail partners?

There’s precedent for ancillary revenue streams like slotting fees. But retailers should be certain they understand the role that intermediaries like Instacart plan to play.

If there’s one thing we know about commerce in 2016, it’s that “same old same old” is over. Every company is looking for inventive ways to present itself to consumers. It only makes sense that Instacart would partner with brands to create a symbiotic relationship for customers, disintermediating traditional media outlets. Go where the customer is!

The current e-commerce system of pricing wars and free deliveries at a minimum price point is not sustainable in the long run. It’s like the pre-dotcom bubble days where the cost of customer acquisition far outweighed ROI. Somewhere, to give consumers the deals and concierge services they are getting used to, someone has to pay. So for grocery, this is a logical step. It’s kind of a cross between manufacturer coupons and slotting fees where everyone has some skin in the game and the consumer gets a fair deal and good service without ultimately driving away the grocer’s margins.

It’s logical for CPG brands to play in role in advertising and couponing on Instacart’s site. What is alarming is Instacart’s need to improve its profitability through brand advertising, price increases and wage cuts. It appears that the economic model on which Instacart launched the business no longer works, and these moves raise questions about the viability of a pure-play home delivery business in the grocery industry.

Furthermore, Instacart’s model for delivering coupon discounts at checkout is hardly revolutionary. Most grocery retailers have offered this capability for years through digital coupons loaded to their loyalty card.

If there are customers, there will be offers from manufacturers. Instacart is just another channel selling products.

I like that manufacturers can offset some, if not all, of the delivery fees and that they can reward consumers instantly for making purchases. The easier it is to make a purchase, the more likely the sale.

Given that print/radio ads really don’t perform as they used to everyone is looking at alternative venues for catching consumer eyeballs. Paying for these venues in more interesting ways is a bit inevitable.

As a consumer I begin to wonder what the value of that box of cereal really is. Cost (whatever that is) plus the cost for the vendor to defray direct advertising, rebates and promotions, warehouse penalties, and then the retailer has to add on more to defray credit card processing, rewards programs, etc. I’m betting for some products that the cost of all these “add-ons” exceeds the cost of the product.

When did coupon redemption become grocery delivery subsidizing? Coupons are one of many merchandising tools. Electronic coupons are increasingly becoming the norm. They are automatic when my frequent shopper card is available on my smartphone. The idea that online prices are lower than retail stores is not valid. They should be but they are not. Except for a few everyday low price retailers most retailers advertise, use price reduction as promotions and accept coupons. This is no different for every online store. National and regional brands will use electronic coupons as they see the direct result and only pay for results. When the store and online are out of sync, the consumer will know and adjust shopping accordingly.

The problem is that free delivery is far too large a burden for smaller margins to support. It makes sense for vendors to support the movement with advertising and rhetoric. After all, this only strengthened the public demand and serves to fasten the burden on the ones that created it: retailers themselves.

The problem is the word “free.” There is never a service without cost and no matter where the accountants put it the money requirement is passed through to the consumer. Today’s consumer is more aware of the final cost out-of-pocket than ever before. But the knowledge and calculation of landed costs when traveling locally to grab a deal still escapes the general public. The push back on local delivery charges is support for this dilemma and not an expansion of the free delivery mess. The solution is to offer pickup or pay a transaction that will most likely fall flat on its face like any other offer out there, as in “Prime.”

For the past 20 years we have seen these businesses come and go. Success depends on consumers buying overpriced name brand products when the trend has been moving more into private label. Vendors will eventually see no return on subsidizing a failing business. In the end I don’t see consumers, brands or retailers gaining anything. Consumers want a good deal without having to clip coupons and struggle through over-commercialized websites.

In the end vendors will continue to do co-op programs to move their products through grocery stores. What the stores choose to do with it to incentivize product sales is always evolving. If the consumer motivation is a 50-cent off coupon, free delivery, loyalty points, size upgrade, BOGO, etc., the co-op dollars will fund this in one form or another. Free delivery is just the latest means to incentivize consumers in the digital age. At some point, free delivery might be table stakes, so e-commerce merchants will need to find the next edge to gain consumer attention. I think this will be customization and personalization and that will have a price as well. Coming full circle, co-op dollars will likely fund this as well.

This type of model definitely has legs and will be well received by the customer. It is always good to see the vendors putting some skin in the game.

Consumers win, vendors get their product s sold and retailers gain some loyalty. The part I don’t get is the delivery costs. These coupons sound like they are being taken off the consumer’s ticket and they are not always a free delivery coupon.

Furthermore, $5.99 hardly pays for an Uber or Lyft driver to get the groceries where they need to go. That is, unless they are developing some sophisticated software that can marry up deliveries with set times and zip codes so the driver can do multiple deliveries within a tight area.

I know that Lyft has tried to implement ride sharing, and their software is pretty doggone good, but in spread-out cities like Atlanta, rarely does a driver end up getting multiple riders. Just sayin’.

For my 2 cents.

The leading obstacle to the growth of online grocery shopping is the delivery cost. Consumers don’t want to pay for delivery. If this cost can be paid by others, it would encourage more consumers to sign up.

This Instacart foray into vendor-paid promotions is a too-little-too-late attempt to re-engineer the impossible economics of grocery home delivery. Some CPG brands will find this new shopper marketing channel attractive, but there are many competing ways to spend trade promotion dollars. We’ve seen this before — you can’t fix a poor-performing supermarket by squeezing more marketing dollars out of vendors.

After more than two decades of study, I have come to the inescapable conclusion that while online or mobile grocery ordering can be efficient, home grocery delivery is a premium service, attractive only to households with more money than time or a few with special needs.

Click-and-collect models, on the other hand, have a future, because these substitute optimized item picking for awkward in-store shopping and also shift the delivery timing and costs back to the consumer. If I were a brand marketer, I’d look to click-and-collect grocers as a channel to promote my products. Targeted sampling would be a great technique in that context.

This is great for brands and good for consumers, but for retailers this is coming out of budgets that used to buy end caps.

Some retailers will see this as a further replacement of the store by an app — and in the case of a 3rd party app that doesn’t bear the retailers name, that could be very dangerous. There will come a time when retailers and 3rd party apps (like Instacart) disagree on who owns the shopper relationship, and the retailers without their own apps be in a tough spot.

If Instacart can draw enough users, then this may help to defray their costs a bit. But these dollars come from somewhere, as other contributors have stated, so there is competition for these funds. Ad-funded won’t defray much of the end-cost, eventually the value of this service will justify the price … or not.

No. Subsidizing a model that promises no increases in sales (consumers don’t stop purchasing groceries just because they cannot buy them online) offers no incremental incentives for a manufacturer. The same applies to couponing. Managing pricing and positioning through other means of promotions and advertising will simply increase rather than just using coupons.