The next logical step for category management

How should retailers reinvent the center store?

What does it take to thrive in an over-stored marketplace?

Why in-store merchandising has to change

Is brick & mortar ready to leverage in-store shopper data?

Should sales guide pricing decisions?

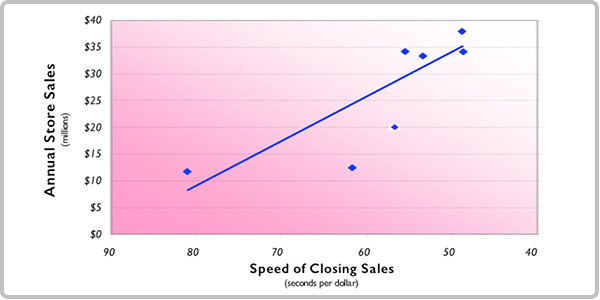

Making the case for shopper time management

Are stand-alone loyalty approaches anachronistic?

Are retailers ready to deal with ‘Gargantuan Data’?