Is it time to reinvent category management?

Omnichannel changes how retailers make price and promo decisions

What does it take to deliver on the promise of customer centricity?

‘One size fits all’ doesn’t work for Millennials

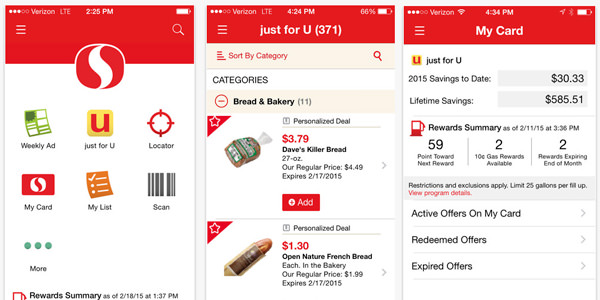

Will personalized pricing ever make it to brick & mortar stores?