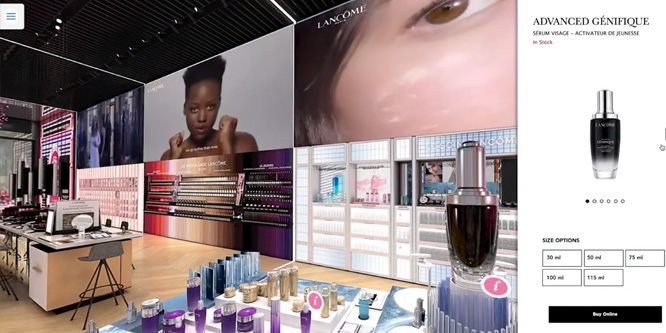

Is retail ready for the phygital future?

Are you ready for the retailer-as-service revolution?

Wholesale curtailed. Is retail’s favorite model faltering?

Retail’s new cobbling economy

Retailers finding answers in-house, through partnerships and acquisitions

Amazon is (quietly) upending private branding. Will others follow?

What bad habits do retail solution providers need to break?

Can licensing safeguard against retail downsizing?

How can retailers achieve consistent branding across touchpoints?