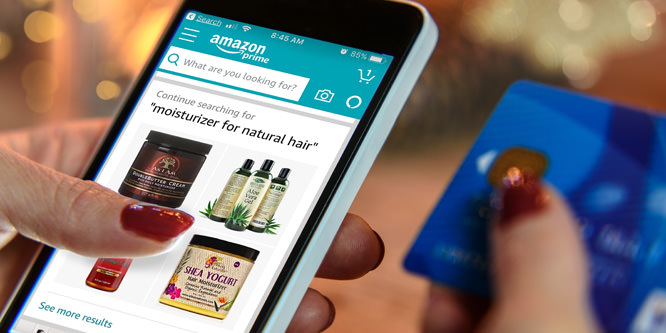

Source: Amazon.com

Will Amazon conquer digital advertising platforms next?

Brands and retailers are shifting major advertising budgets to the Amazon platform at the expense of incumbents like Google and Facebook. Relative to other advertising channels, brands can reach customers at a low cost via Amazon, and the path to purchase is very short. Gold Eagle Company, an automotive aftermarket manufacturer, sees a $5 return on every $1 spent on Amazon Sponsored Products compared to a break-even result with Google Adwords.

One equity analyst predicts Amazon will quadruple its advertising revenue by 2020. This would take Amazon’s estimated share of the digital advertising industry spend from around 3.5 percent in 2016 to over 10 percent by 2020 based on eMarketer estimates.

Who will be the winners and losers in Amazon’s pursuit of digital advertising wallets?

Winner #1: Amazon will generate more high-margin advertising revenue, pleasing investors and subsidizing thin retail margins. Further, a heightened ability to affordably reach consumers through paid search may finally coax big brands who have eschewed Amazon in the past to finally develop an active presence on the site.

Winner #2: Advertisers will benefit from Amazon’s continued investment in the platform. While the interface and reporting currently lags behind other platforms, given a huge increase in potential revenue from its advertising products, Amazon will make it easier and more compelling for advertisers to spend their ad budgets. The tangible outcome will be better reporting, more tools, more ad types, advanced targeting, etc.

Loser #1: Google and Facebook, the two incumbent digital advertising giants, stand to lose some share of the digital advertising market. Amazon’s investment will create pressure for these incumbents at the very least.

Loser #2: Brands, retailers, and digital advertising agencies who are late to the game. Advertisers typically gain momentum from mature campaigns and extensive historical data. Also, Amazon’s paid search ads come relatively cheap right now, but the platform will become more competitive as new brands enter and increase their spend.

Discussion Questions

DISCUSSION QUESTIONS: How will Amazon fit into the broader digital advertising ecosystem, both as a competitor to incumbents and as a platform for brands? What other winners and losers will emerge as a result of Amazon’s gain in the digital advertising space? Will Amazon finally begin to share more consumer data to help advertisers measure advertising performance?

With the serious issues Google and Facebook have around political campaigns and Russia, Amazon has the opportunity to accelerate its position in the digital ad marketplace. And this stunning investigative piece by BuzzFeed demonstrates just how rotten the whole ad ecosystem is today.

Some bad actors do not make the whole ad ecosystem rotten.

Amazon is a marketplace to search for products. Therefore Amazon’s search engine is focused on connecting the correct product for the users’ search. Google is a search engine for answering a question. Facebook is a highly-targeted social platform.

So if you are a brand selling a product, then Amazon is the correct place to spend your ad dollars to drive sales. There are several different components to the ad platform. Some are self-managed and others are managed by AMS. Because Amazon is highly directed at brands and products, the spend is efficient. And as the marketplace grows in importance, ad dollars will continue to be directed there. If 59 percent of all product searches begin on Amazon then you can see how most of the product ad dollars will move in that direction. Amazon continues to improve its ad system for re-targeting and headline ads, opening these up to FBA sellers, which are powerful systems.

Google is not losing, however. Spend on Google Adwords grew 21 percent last quarter. So let’s not count them out just yet. But you need to understand its limitations. Facebook/Instagram is emerging as a huge force in the ad game because of the ability to hyper-target your audience with above average ROAS.

More and more ad dollars will move into these digital delivery products and the real losers will be TV, print and digital newsletters. All of these have been declining in ad revenue over the last few years. But that decline will accelerate rapidly in the next two years.

Nailed it Phil.

Different platforms with different purposes for the consumer require different brand-building strategies and spends. Amazon to buy stuff = paid ads. Google to find stuff = SEO spending and Facebook to tell friends about stuff = what I call “digital word of mouth.” I also second your opinion that Google and Facebook are doing just fine with building their own ad streams. The ad spend numbers, their profitability and their stock price all bear that out.

Great points, Phil!

Amazon, with its already omnipresent position in our daily lives, would be wise to explore additional opportunities to promote the brand and potentially drive incremental members to the Amazon Prime membership pool, as well as push consumers to purchase Alexa.

A subtle approach to advertising would be wise, as the Amazon brand virtually sells itself these days with the seemingly daily public relations activity. A focus on social responsibility will resonate with not only the Millennial generation but with all generations.

A recent Burger King advertisement covered the controversial topic of bullying. The spot had subtle product references but focused on something more meaningful than the actual product. Amazon may be wise to implement a similar approach and take full advantage of what appears to be a void in the industrial advertising complex.

Integrating the elements of consumer commerce that include advertising, product promotion/display and fulfillment with the strong foundation of analytics that can tie these all together, makes Amazon the retail force that it is. The eyes of marketers are always on the finish line of lifetime customer revenue at the lowest cost of acquisition and retention, and the most marketers start how they plan to finish with advertising driving sales. Advertising is essential to commerce and is the natural business for Amazon which has an ongoing contribution to make to the economies of commerce.

The big advantage Amazon has over competitors is the round-trip aspect of advertising and fulfillment under one roof. Everywhere else, an ad is seen and if it generates interest, the shopper is transported to another place to complete the transaction. Amazon removes some of the friction between the offer and the fulfillment saving consumers effort and time.

Effectively every headline-grabbing concept the press eats up is subterfuge while they stealthily are moving the big gun of Amazon advertising into place. Brands and retailers needn’t fear drones, Amazon Key, and the like. This is where the real future impact is going to be leveled from.

Excellent comment!

Thank you Kiri for this timely article. Through their marketing services, Amazon operates as a digital advertising platform (supply side) for merchants selling on its website and mobile app. Compared to Google and Facebook, Amazon has an absolute cost advantage as well as being more tuned to the purchasing moment for consumers; together these generate a lower keyword cost of sale for merchants. On the downside, usability issues of the Amazon marketing platform are cumbersome and manually intensive, but I expect that will change as Amazon moves further into digital advertising.

For Amazon, this is a new and fast-growing revenue stream. The company collects its usual selling fee from the merchant in addition to the incremental ad revenue. While the digital advertising model has been core to Facebook’s monetization, for Amazon it’s a downstream result of the depth and breadth of its reach of Amazon Prime and the underlying data. An unintended result of Amazon’s anticipated success in this area is that Google and Facebook will likely open up their walled gardens and allow price discovery. Such transparency will be highly welcomed by all ad buyers from retailers to brands and more.

If we go outside of the single channel digital advertising model, the real prize is for agencies and brands to be able to deliver their messages in a personalized and contextually-sensitive way across devices (mobile, connected TV, digital radio, etc.) and situations while bridging the physical and digital. Opt in customer identity management becomes the Holy Grail in order to follow the purchase journey from search and exploration to purchase and use. We’re still in the first inning of the entire digital advertising era.

I think the time frame is critical here. While Phil and Ben are right in the near term, I think we have to consider that Amazon’s game may change over time. Their pattern is to experiment first, gain a toehold, maximize opportunity and then move to what I’m sure some of their competitors see as predation, but what I’ll call hyper-competition. So today they have a clearly differentiated goal and approach. But tomorrow, who can say that they won’t try to out-Google Google? After all, if your mission is to surround a consumer and filter out competition, why stop at selling stuff? As to winners and losers, time will tell. technology has a nasty habit of evolving through disruption. As to sharing, that again depends on how you believe Amazon will define its long game. I could envision a future in which Amazon would want to block out non-Amazon advertising vehicles, so why share any more than you have to now?

I agree. Long-term strategy also depends upon how consumer behavior changes. Now consumers search on Google when a broad search is required and search on Amazon to see what is available there. That may change with more advertising on Google or Alexa, or some new technology may change consumer behavior.

Amazon has a huge lead in attracting consumers to their platform. It has been the nature of their platform and extensive investment since early in the company’s existence. Their move to a mobile platform was early and is paying off with many consumers picking Amazon as their first website to scan for any purchase. Therefore, it is natural for any brand or retailer to want to advertise on Amazon as a priority. The short-term losers of this movement to advertising on Amazon are Google and brand-specific sites. Having said that, I do not see Google sitting still while this happens. I believe Google will expand its marketplace with Walmart, Target and other retailers and brands in the future. As the Google Marketplace grows, it will provide major competition to the Amazon Marketplace and will provide a viable alternative to advertising on Amazon.

Amazon will over time provide consumer data to help advertisers measure performance vs. the cost of advertising. As the competition heats up in the advertising space, the pressure to provide this data will increase.

Another win for Amazon beyond the advertising revenue — and a win for brands (assuming good ROI) in an increased sales rate of products. With an endless shelf, products can get lost unless there is a way to promote.

Wolf in sheep’s clothing. Entice with low rates, dominate, conquer brands.

Among our ecommerce clients, we see an interesting edge from Facebook over Google when doing video retargeting, but we also tend to see better results when we run ads in both platforms, and not just in one. I believe that adding Amazon will be adding to the ad efficiency and I really don’t see it as “cannibalizing” the other ones. Purpose is so much different. Facebook and Google will just do well and this is exciting to have another player in the game.