Source: Target

Will Target’s answer to Prime Pantry help it outdo Amazon?

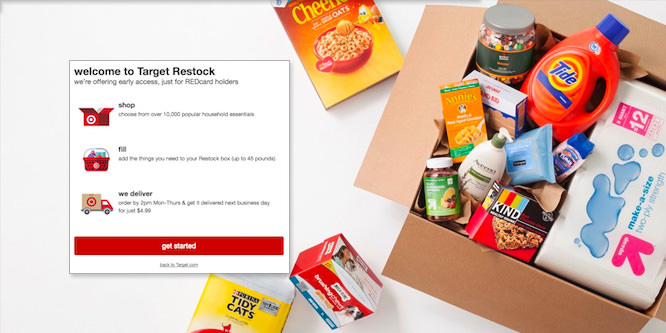

Target launched a pilot of its next-day delivery program for household essentials yesterday in the Minneapolis/St. Paul area. Now, the question is whether the program, known as Target Restock, will prove successful in driving increased sales for Target.com.

The pilot program gives shoppers a choice of more than 10,000 everyday items including baby, beauty, household products, personal care, pet and shelf-stable foods. Orders are added to a box that holds up to 45 pounds. Shoppers are updated on how much more room is available in the box as they add items to their cart. Items ordered by 2:00 p.m. are delivered the next day for a fee of $4.99. The pilot will be restricted to REDcard members during its initial phase.

“Target Restock is all about making the Target Run easier — and helping our guests save time in their busy lives,” said Mike McNamara, chief information and digital officer, Target, in a statement. “We look forward to seeing how guests in our hometown market respond to this new offering.”

The mass merchant’s venture into next-day delivery puts it in the same territory as Amazon.com’s Prime Pantry service, which also delivers grocery and household staples. Amazon’s program, which is restricted to Prime members, allows shoppers fill up a box for a $5.99 fee. Members can receive free shipping when they include five qualifying items in their box. The service also allows Prime members to clip coupons on the Pantry page for additional savings. There is a maximum weight of 45 pounds for each box.

Matt Sargent, senior vice president of retail for Magid, told the Star Tribune that his company’s research has found that 57 percent of Target’s regular customers are also Amazon Prime members.

In a recent research note, the paper reported, Mr. Sargent wrote that “Target Restock is squarely aimed at taking share back from Amazon” and that the need for the program “to succeed cannot be underestimated.”

- Target Launches Next-Day Essentials Delivery in the Minneapolis Area with Target Restock – Target

- Target’s next-day essentials delivery service opens to customers in pilot test – TechCrunch

- Target Restock launches this morning in Minnesota – Minneapolis Star Tribune

- Prime Pantry – Amazon.com

- Will next day delivery make Target an omnichannel force? – RetailWire

Discussion Questions

DISCUSSION QUESTIONS: What do you think Target is likely to learn from the pilot of its Restock next-day delivery program? Do you agree that Restock needs to capture Amazon.com customers to be considered a success?

We have seen many UK supermarkets launch initiatives just like this in the face of Amazon increasing pressure on the last mile and grocery delivery. In fact Tesco, the biggest supermarket in the UK, launched a very similar promotion earlier this week called Tesco Now.

In my opinion this is about playing keep-up and not so much about stealing market share or gaining Prime customers. Many of those customers are too embedded in the Amazon ecosystem with Prime delivery, TV and Alexa. With playing keep-up, it’s about retention and not losing those customers who are still not Prime converts.

I think this is a smart move for Target. There is more competition today than ever and it’s important that retailers stay in the game. Target and Walmart are both doing everything they can to compete with Amazon as Amazon is doing everything it can to not only expand its core business but branch out in the brick-and-mortar space. Not everything these companies test will be successful, but it will help them bring their businesses to their next step in evolution for survival. The risk is always cost. Consumers today can take advantage of so many new offers, store concepts and services, and that makes it exciting!

Target Restock will not win back many customers from Amazon Prime but it may keep others from joining or using their Prime membership to purchase items that they can get from Target. This move is what happens when something that was once a “needed to win” becomes a “needed to play.” Even if it is not successful you can anticipate that other retailers will try a similar approach to hold onto their customer base.

It’s definitely a “me too” strategy and that kind of strategy never has a payoff as big as the leader. I’m in agreement here that the Target program will be more successful in retention vs. new customers. It’s time for Target to start thinking beyond what their competitors are doing to how they can better serve the customer.

I understand the Amazon and brand interest in Prime Pantry — increasing basket sizes and selling products that don’t lend themselves to club-sized packs. But I’ve never understood the consumer shopping mission that these offerings fill. As a consumer, I’ve never said to myself “I’d really like a box full of stuff.” I get it in niches — sending the kids off to college, got a new pet, etc … but I’m very surprised that Prime Pantry has had the success that it has.

This is just the latest example of retailers meeting in the middle to serve shoppers. Just watch the gorillas — Amazon is moving into stores, Walmart is buying pure-plays.

Regarding the headline “Will Target’s answer to Prime Pantry help it outdo Amazon?” Are you kidding? Target outdo Amazon. Sometimes I think Target can’t even outdo Target. This is more “silver bullet” thinking. In my mind, no retailer flails like Target.

This is a smart and necessary move for Target. Anything a retailer can do to provide similar “convenience experiences” that Amazon does will allow them to continue to compete. When it comes to Amazon Pantry, the product selection is a bit limited. If Target can provide a larger breadth of products then they have a real opportunity to win back some of the market share they may have lost to Amazon Pantry customers.

Target’s Restock program is a smart response to Amazon’s Prime Pantry. While Target has the advantage of local distribution centers (its stores) in nearly every city, they will have a learning curve from a process perspective. Training employees to efficiently pick, pack and ship orders is essential to effectively deliver as promised. This is a totally new process for Target employees and missteps are costly.

Since 57% of Target customers are Amazon Prime members, it will be essential that Target captures some of these customers. Since the shipping costs are slightly lower for Target and REDcard members will get an additional 5% discount if they pay with their REDcard, this should be a compelling reason to order from Target instead of Amazon.

I believe this type of service is now table stakes to play in retail today. You can’t just give up and surrender the field to Amazon. You have to innovate and execute. Go Target!

I think Target is likely to learn yet again that competing with Amazon on price is a no-win situation when they are judged by quarterly growth and same store sales metrics by investors and Amazon investors only care about growth and are willing to lose money to take market share.

I don’t think they will convert many Amazon shoppers but may get people who are considering these option to try it with them first especially for REDcard members. Starting with REDcard members is a smart move and this a defensive move that they kind of have to make in the arms race with Walmart and Amazon.

However — this could be a place where they really could cannibalize sales, which I normally argue against as it related to e-commerce and omnichannel sales. Strictly anecdotal, but when I roll into a Target to buy something like paper towels, I walk out with a new blender, books for my kids and more. I can see how they are trying to encourage that with letting people know how much is left in the box, but certainly not the same.

I think I speak for all of us when I say it’s getting harder and harder to take seriously a retailer that keeps calling its customers “guests” … a phrase that jumps the shark when they’re not even in the store.

But back to the main topic. This idea fills me with … questions. Is this really a good idea or just a blind emulation of Amazon? How will Target measure success (since Amazon seemingly doesn’t use conventional metrics like, ya know, making money)? If it doesn’t seem to be working out, how long will the effort run?

Oh and while we’re at it, how are the upgrades going to food and the OOS situation at you’re physical stores, where 3/4 — or more — of your business is conducted?

Target will learn several lessons: the interest level in home delivery for $4.99, categories that fit home delivery the best according to consumer demand, and the cost for providing the service. They will understand the ROI for this part of the business and be able to decide if it should the service should be scaled.

Target does not have to capture Amazon customers necessarily. The reason for adding this service is to expand sales. Most of these sales will come at the expense of another retailer, in some cases Walmart or Walgreens. This additional service may be grown by Amazon, but services like this are popping up from many retailers and food delivery providers. Target should learn enough lessons from this project to know whether their is value in proceeding with more stores and attracting increased sales is a viable strategy.

This is a smart move by Target and something that they are in a good position to succeed with, although I’m sure they will have growing pains in the pilot within the store, as I doubt their staff has the processes nailed down to handle this if it’s wildly successful. I expect they will work out all the kinks in the pilot and be able to roll this out nationwide.

Will they steal customers from Amazon Pantry? I’m not so sure, but they may very well find incremental revenue from their existing customer base that hasn’t tried Amazon Pantry yet. I would expect to see other big box retailers try this as well as the “me too” approach to retail is taking over this concept.

This does not seem like a serious move for two reasons. First, the test is being done in their back yard. The home town crowd cannot be considered representative of the market at-large. Second, the timing of Target’s recent extension of payment terms seems more than coincidental. At least they are going down swinging.